机构IPS经典题第四页的2.1,请问return objective为什么是对的?我认为应该是4%+2.5%+1%+0.65,这个题和2016年A1的第一问很像,也是把spending rate加上管理费,加上通胀,加上费用增长,为什么这个题不选B啊?

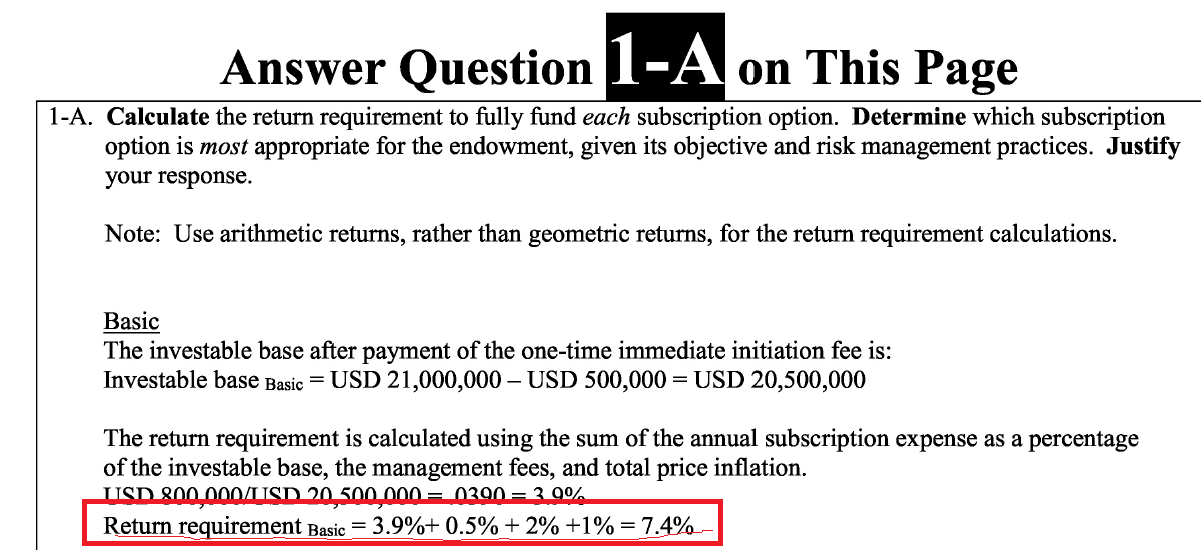

我把2016年机构IPS真题截图了,如下

韩韩_品职助教 · 2018年06月09日

同学你好,这里的症结在于这句话:The university’s operating expenses are expected to grow at a rate of 2.5% annually, while the rate of inflation in the economy is expected to be 1% per year.

我们知道foudation return objective = spending rate + inflation + expense rate. 比较难理解的就是inflation,这里inflation需要跟spending的growth rate来进行一个对比,其实spending的growth rate也是一种inflation的调整,所以如果growth rate of spending是比整体经济环境下预计的inflation要大(就是题目中说的这种情况The university’s operating expenses are expected to grow at a rate of 2.5% annually, while the rate of inflation in the economy is expected to be 1% per year. ),那么说明spending的growth rate是足以cover inflation的调整的,这样我们就可以直接用题目中说的growth rate就可以,不用在growht rate基础上再加上inflation.

所以这个题的return = 4%+2.5%+0.65%=7.15% which is belongs to 7-7.5%, 所以return objective是正确的。