NO.PZ2023032701000079

问题如下:

As of February 2007, you are researching Jonash International, a hypothetical company subject to cyclical demand for its services. Jonash shares closed at $57.98 on 2 February 2007. You believe the 2003–2006 period reasonably captures average profitability:

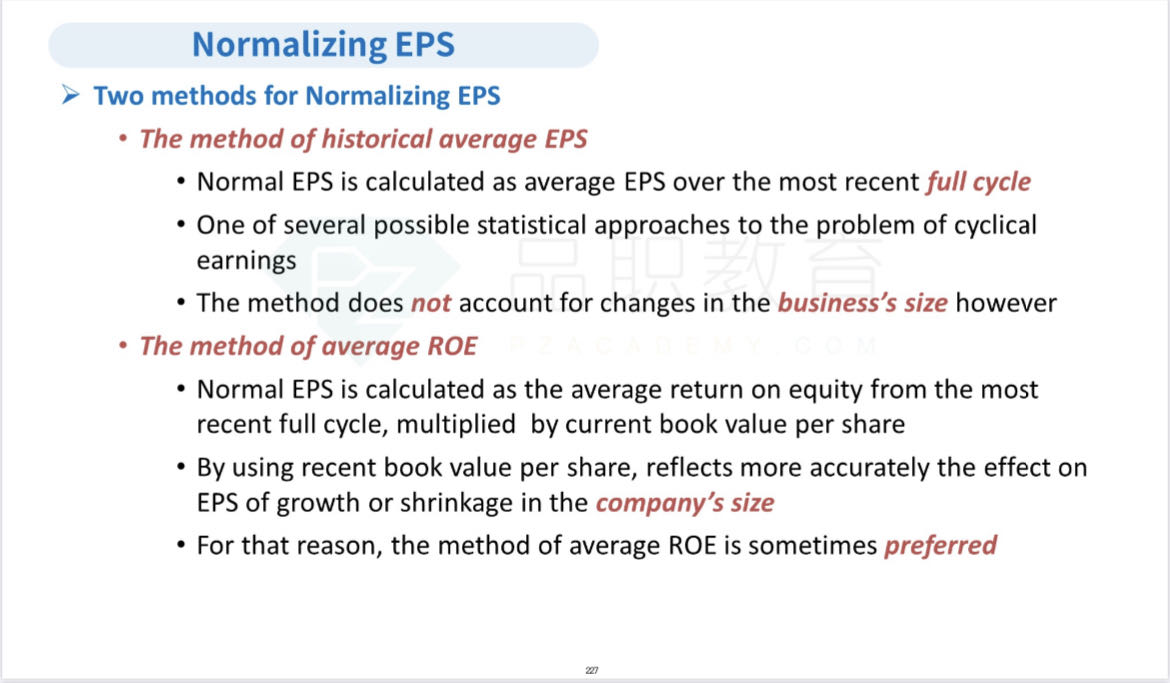

When calculating normalized EPS, we can use on the method of historical average EPS or method of average ROE, the difference of PE calculated by the two methods is:

选项:

A.11.6

B.12.5

C.13.4

解释:

Averaging EPS over the 2003–2006 period, we find that ($2.55 + $2.13 + $0.23 + $1.45)/4 = $1.59. According to the method of historical average EPS, Jonash’s normalized EPS is $1.59. The P/E based on this estimate is $57.98/1.59 = 36.5.

Averaging ROE over the 2003–2006 period, we find that (0.218 + 0.163 + 0.016 + 0.089)/4 = 0.1215. For current BV per share, you would use the estimated value of $19.20 for year-end 2007. According to the method of average ROE, 0.1215 × $19.20 = $2.33 is the normalized EPS. The P/E based on this estimate is $57.98/$2.33 = 24.9.

So the difference is 36.5-24.9=11.6

为什么不用调和平均数计算?什么情况下用调和平均数计算?