NO.PZ2022062761000027

问题如下:

A portfolio manager uses a valuation model to estimate the value of a bond portfolio at USD 125.00 million.

The term structure is flat. Using the same model, the portfolio manager estimates that the value of the

portfolio would increase to USD 127.70 million if all interest rates fall by 20 bps and would decrease to

USD 122.20 million if all interest rates rise by 20 bps. Using these estimates, which of the following is the

effective duration of the bond portfolio closest to?

选项:

A.

5.5

B.

11

C.

22

D.

44

解释:

中文解析:

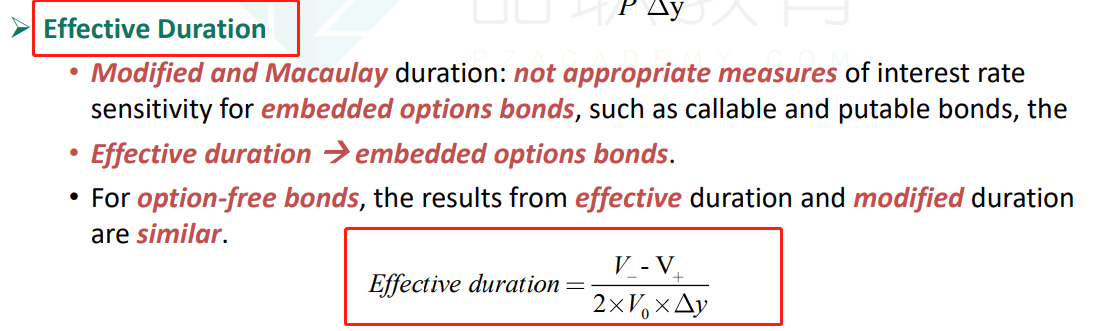

duration的计算,过程如下:

选B

Duration is the approximate percentage change in price for every 100 bp change in rates.

The calculation follows:

A is incorrect. 5.5 is the result of using switching the prices of USD 122.20 and USD 125.00 in the formula.

C is incorrect. 22 is the result when the “2” multiple in the denominator is not applied.

D is incorrect. 44 is the result obtained if the “2” multiple is applied to the numerator

instead of the denominator.

老师好,请问这里为什么不用d=v_+v+ -2v/y²✖️v,这个公式?