NO.PZ201812100100000406

问题如下:

Based on Exhibit 1 and Note 1 in Exhibit 2, the amount that Ambleu should include in its 31 December 2017 revenue from Cendaró is closest to:

选项:

A.NVK10.60 million.

B.NVK13.25 million.

C.NVK19.73 million.

解释:

A is correct.

Crenland experienced hyperinflation from 31 December 2015 to 31 December 2017, as shown by the General Price Index, with cumulative inflation of 128.2% during this period. According to IFRS, Cendaró’s financial statements must be restated for local inflation, then translated into Norvoltian kroner using the current exchange rate. The 2017 revenue from Cendaró that should be included in Ambleu’s income statement is calculated as follows:

Revenue in CRG × (GPI 31 December 2017/GPI average 2017) = Inflation-adjusted revenue in CRG

CRG125.23 million × (228.2/186.2) = CRG153.48 million

Inflation-adjusted revenue in CRG/31 December 2017 exchange rate (CRG/NVK) = Revenue in Norvoltian kroner

CRG153.48 million/14.4810 = NVK10.60 million

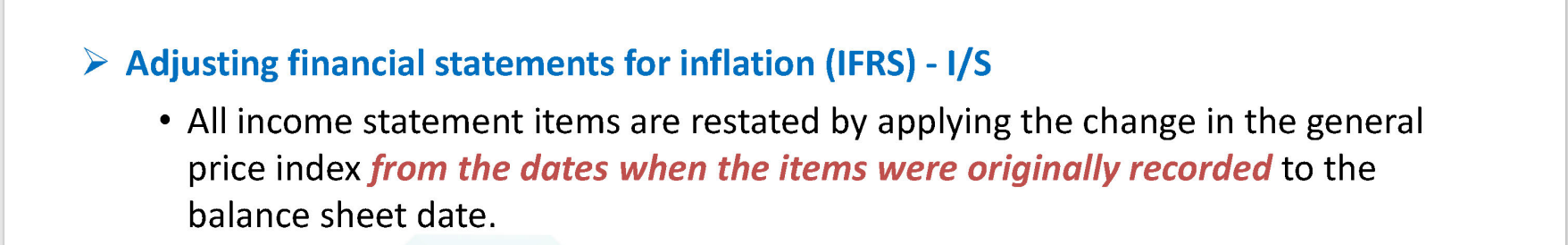

解析:考点是hyperinflation情况下translate方法。母公司遵循IFRS,因此在转换C公司报表之前需要先restate,然后再使用current exchange rate转换(注意不是current rate method)。C公司当年的revenue是125.23,restate要基于平均值:125.23*(228.2/186.2)=153.48CRG,当前汇率是14.4810CRG/NVK,转换后的revenue是153.48/14.4810=10.6NVK

为什么先除平均再乘年末的数就是考虑通胀之后的数值?不太明白这个公式背后的逻辑