NO.PZ202105270100000501

问题如下:

Judith Bader is a senior analyst for a company that specializes in managing international developed and emerging markets equities. Next week, Bader must present proposed changes to client portfolios to the Investment Committee, and she is preparing a presentation to support the views underlying her recommendations.

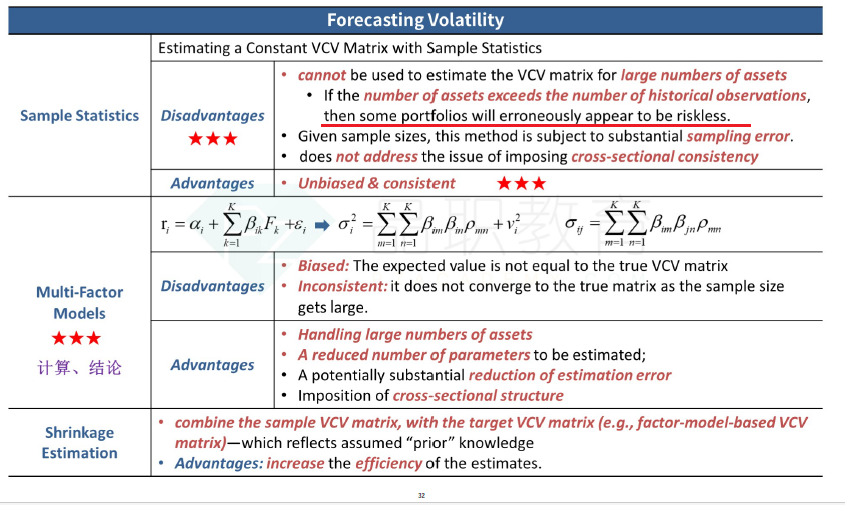

Bader begins by analyzing portfolio risk. She decides to forecast a variance– covariance matrix (VCV) for 20 asset classes, using 10 years of monthly returns and incorporating both the sample statistics and the factor-model methods. To mitigate the impact of estimation error, Bader is considering combining the results of the two methods in an alternative target VCV matrix, using shrinkage estimation.

Bader asks her research assistant to comment on the two approaches and the benefits of applying shrinkage estimation. The assistant makes the following statements:

Statement 1 Shrinkage estimation of VCV matrices will decrease the efficiency of the estimates versus the sample VCV matrix.

Statement 2 Your proposed approach for estimating the VCV matrix will not be reliable because a sample VCV matrix is biased and inconsistent.

Statement 3 A factor-based VCV matrix approach may result in some portfolios that erroneously appear to be riskless if any asset returns can be completely determined by the common factors or some of the factors are redundant.

Bader then uses the Singer–Terhaar model and the final shrinkage-estimated VCV matrix to determine the equilibrium expected equity returns for all international asset classes by country. Three of the markets under consideration are located in Country A (developed market), Country B (emerging market), and Country C (emerging market). Bader projects that in relation to the global market, the equity market in Country A will remain highly integrated, the equity market in Country B will become more segmented, and the equity market in Country C will become more fully integrated.

Next, Bader applies the Grinold–Kroner model to estimate the expected equity returns for the various markets under consideration. For Country A, Bader assumes a very long-term corporate earnings growth rate of 4% per year (equal to the expected nominal GDP growth rate), a 2% rate of net share repurchases for Country A’s equities, and an expansion rate for P/E multiples of 0.5% per year.

In reviewing Countries B and C, Bader’s research assistant comments that emerging markets are especially risky owing to issues related to politics, competition, and accounting standards. As an example, Bader and her assistant discuss the risk implications of the following information related to Country B:

- Experiencing declining per capita income

- Expected to continue its persistent current account deficit below 2% of GDP

- Transitioning to International Financial Reporting Standards, with full convergence scheduled to be completed within two years

Bader shifts her focus to currency expectations relative to clients’ base currency and summarizes her assumptions in Exhibit 1.

During a conversation about Exhibit 1, Bader and her research assistant discuss the composition of each country’s currency portfolio and the potential for triggering a crisis. Bader notes that some flows and holdings are more or less supportive of the currency, stating that investments in private equity make up the majority of Country A’s currency portfolio, investments in public equity make up the majority of Country B’s currency portfolio, and investments in public debt make up the majority of Country C’s currency portfolio.

Which of the following statements made by Bader’s research assistant is correct?

选项:

A.Statement 1 B.Statement 2 C.Statement 3解释:

C is correct.

Statement 3 is correct. As long as none of the factors used in a factor-based VCV model are redundant and none of the asset returns are completely determined by the common factors, there will not be any portfolios that erroneously appear to be riskless. Therefore, a factor-based VCV matrix approach may result in some portfolios that erroneously appear to be riskless if any asset returns can be completely determined by the common factors or some of the factors are redundant.

A is incorrect because shrinkage estimation of VCV matrices will increase the efficiency of the estimates versus the sample VCV matrix, because its mean squared error (MSE) will in general be smaller than the MSE of the (unbiased) sample VCV matrix. Efficiency in this context means a smaller MSE.

B is incorrect because, although the proposed approach is not reliable, the reason is not that the sample VCV matrix is biased and inconsistent; on the contrary, it is unbiased and consistent. Rather, the estimate of the VCV matrix is not reliable because the number of observations is not at least 10 times the number of assets (i.e., with 10 years of monthly return data, there are only 120 observations, but the rule of thumb suggests there should be at least 200 observations for 20 asset classes).

表述三是正确的。只要基于因素的风险现值模型中使用的所有因素都不是冗余的,而且没有任何资产回报完全由公共因素决定,就不会有任何投资组合错误地看起来是无风险的。因此,基于因子的VCV矩阵方法可能导致某些投资组合错误地看似无风险,如果任何资产收益完全由公共因子决定,或某些因子是多余的。

A是错误的,因为相对于样本VCV矩阵,收缩估计VCV矩阵会增加估计的效率,因为其均方误差(MSE)一般会小于(无偏)样本VCV矩阵的MSE。在这种情况下,效率意味着较小的MSE。

B是错误的,因为虽然所提出的方法是不可靠的,但原因不是样本VCV矩阵有偏差和不一致;相反,它是无偏的和一致的。相反,VCV矩阵的估计不可靠,因为观测的数量不满足至少10倍于资产数目的要求(例如,用十年的月度数据回测,只有120年的观察,但经验法则表明应该有至少200观察20资产类别)。

1.factor-based vcv和factor-model-based vcv是同一个东西吗?

2.框架图里面some portfolios that erroneously appear to be riskless是sample statistics(vcv)的缺点,题目里factor based vcv也有这个特点。那么这两者的关系是什么?