NO.PZ2016012102000205

问题如下:

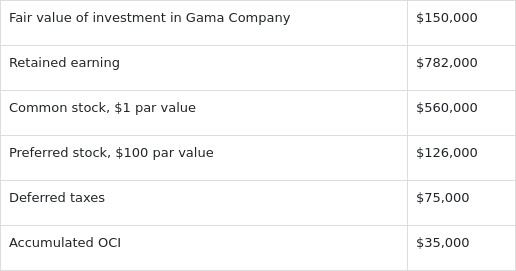

The following is the balance sheet of Theta Company with selected data at the end of the year:

The investment in Gama Company cost $130,000 and is classified as FVOCI. At the end of the year, Theta Company's total owners' equity is closest to:

选项:

A.$1,500,000.

$1,503,000.

$1,894,000.

解释:

B is correct.

Total stockholders' equity consists of common stock of $560,000, preferred stock of $126,000, retained earnings of $782,000, and accumulated other comprehensive income of $35,000, for a total of $1,503,000.

Total stockholders' equity = common stock of $560,000 + preferred stock of $126,000 + retained earnings of $782,000 + accumulated OCI of $35,000 = $1,503,000

考点:计入OCI的项目

股东权益总额包括 $ 560,000的普通股、$ 126,000的优先股、$ 782,000的留存收益 和 $ 35,000的累计其他综合收益,总计$ 1,503,000。

FVOCI的未实现损益已经计入累计OCI中,不用再次计算。

递延所得税,由于retained earnings是由每期的NI累积出来的,NI是税后的金额,是净利润了,不受到tax的影响。所以这道题的tax是混淆条件。

老师您好,

投资到 Gama Company 赚取的当年收益20,000计入OCI,这个为什么没有算入呀?

谢谢老师。