NO.PZ201809170400000504

问题如下:

Monongahela Ap is an equity fund analyst. His manager asks him to evaluate three actively managed equity funds from a single sponsor, Chiyodasenko Investment Corp. Ap’s assessments of the funds based on assets under management (AUM), the three main building blocks of portfolio construction, and the funds’ approaches to portfolio management are presented in Exhibit 1. Selected data for Fund 1 is presented in Exhibit 2.

Ap learns that Chiyodasenko has initiated a new equity fund. It is similar to Fund 1 but scales up active risk by doubling all of the active weights relative to Fund 1. The new fund aims to scale active return linearly with active risk, but implementation is problematic. Because of the cost and difficulty of borrowing some securities, the new fund cannot scale up its short positions to the same extent that it can scale up its long positions.

Ap reviews quarterly holdings reports for Fund 3. In comparing the two most recent quarterly reports, he notices differences in holdings that indicate that Fund 3 executed two trades, with each trade involving pairs of stocks. Initially, Fund 3 held active positions in two automobile stocks—one was overweight by 1 percentage point (pp), and the other was underweight by 1pp. Fund 3 traded back to benchmark weights on those two stocks. In the second trade, Fund 3 selected two different stocks that were held at benchmark weights, one energy stock and one financial stock. Fund 3 overweighted the energy stock by 1pp and underweighted the financial stock by 1pp.

In Fund 3’s latest quarterly report, Ap reads that Fund 3 implemented a new formal risk control for its forecasting model that constrains the predicted return distribution so that no more than 60% of the deviations from the mean are negative.

Based on Exhibit 2, the portion of total portfolio risk that is explained by the market factor in Fund 1’s existing portfolio is closest to:

选项:

A.3%.

B.81%.

C.87%.

解释:

C is correct.

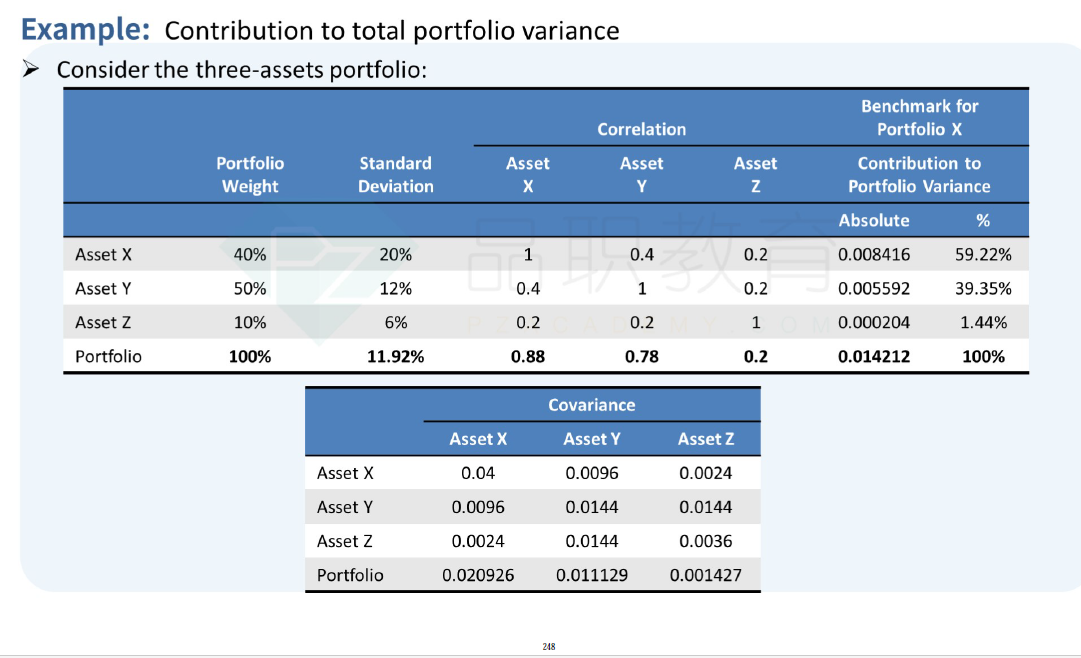

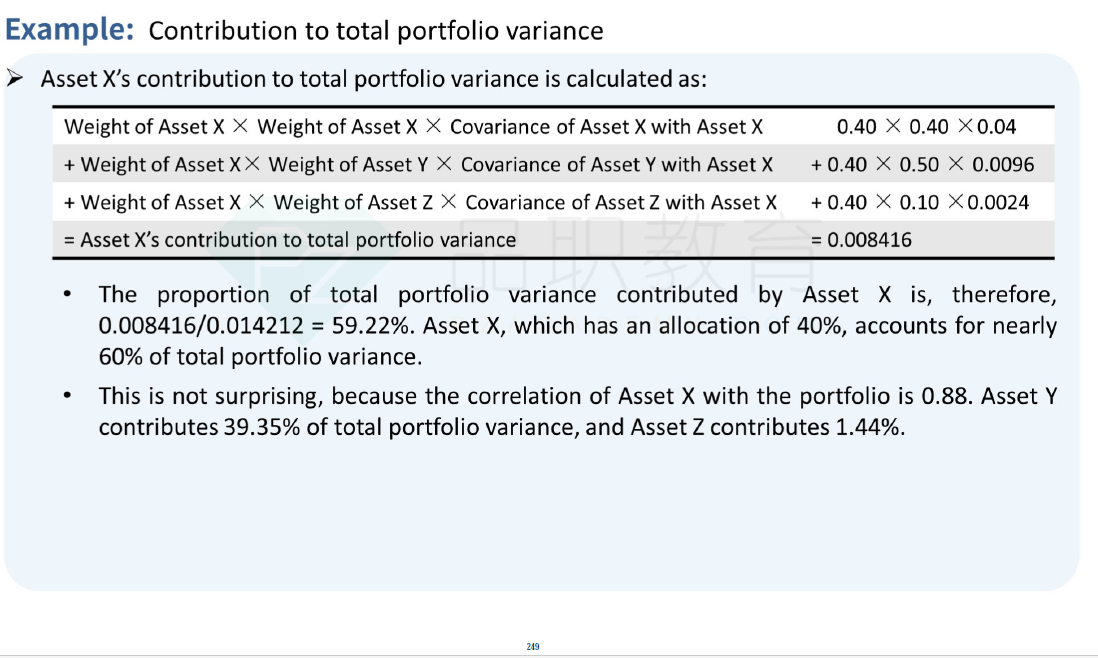

The portion of total portfolio risk explained by the market factor is calculated in two steps. The first step is to calculate the contribution of the market factor to total portfolio variance as follows:

Where

CVmarket factor = contribution of the market factor to total portfolio variance

xmarket factor = weight of the market factor in the portfolio

xj = weight of factor j in the portfolio

Cmf,j = covariance between the market factor and factor j

The variance attributed to the market factor is as follows:

CVmarket factor = (1.080 × 0.00109 × 1.080) + (1.080 × 0.00053 × 0.098) + (1.080 × 0.00022 × –0.401) + (1.080 × –0.00025 × 0.034)

CVmarket factor = 0.001223

The second step is to divide the resulting variance attributed to the market factor by the portfolio variance of returns, which is the square of the standard deviation of returns:

Portion of total portfolio risk explained by the market factor = 0.001223/(0.0374)^2

Portion of total portfolio risk explained by the market factor = 87%

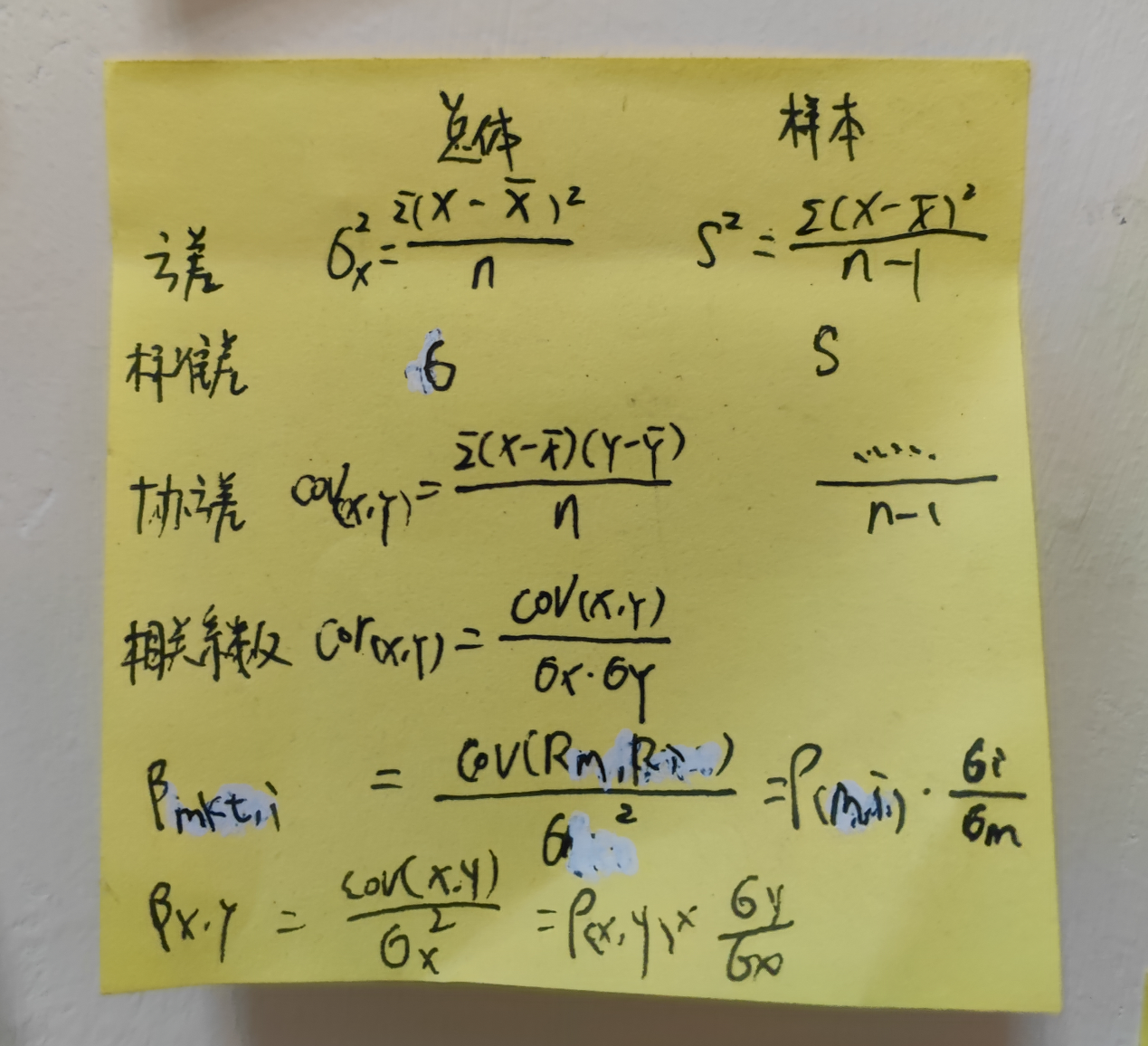

请问老师我写的这个公式是不是错了,因为根据这个公式要除以market return的标准差——X,而不是asset return的标准差——Y。