NO.PZ2023040701000036

问题如下:

Maalouf explains, “Valuation using a binomial interest rate tree is based on the principle of no arbitrage. In order for there to be no arbitrage in a financial market, three conditions must be met:”

• Condition 1: If the risk of any security is higher than that of another, its expected return must also be higher.

• Condition 2: The price of any two risk-free securities with the same timing and amount of payoffs must be the same.

• Condition 3: The price of any portfolio of securities must equal the sum of the prices of the individual securities in the portfolio.

Of the three conditions Maalouf claims are necessary for a market to be arbitrage free, he is least likely correct regarding:

选项:

A.Condition 1.

Condition 2.

Condition 3.

解释:

Correct Answer: A

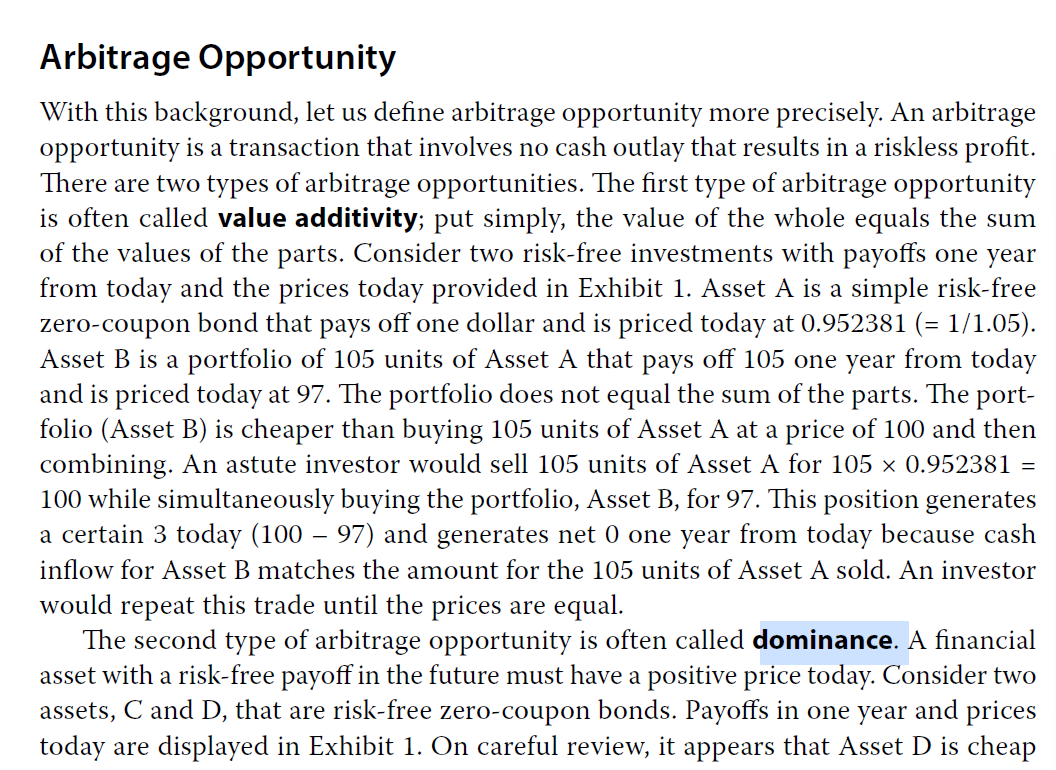

The principle of no arbitrage applies to risk-securities and portfolios, not risky ones. Value additivity (Condition 3) and lack of dominance (Condition 2) must hold for a market to be arbitrage free, but not a relationship between risk and expected return of risky securities.

A为什么错