NO.PZ2023010409000024

问题如下:

The hypothetical Ivy University

Endowment was established in 1901 and supports Ivy University. The endowment

supports about 40% of the university’s operating budget. Historically, the

endowment has invested in a traditional 20% public US equities, 80% US Treasury

portfolio, and it is entirely implemented through passive investment vehicles.

The investment

staff at the endowment is relatively small. With the appointment of a new chief

investment officer, the investment policy is being reviewed. Endowment assets

are US$250 million, and the endowment has a spending policy of paying out 5% of

the 3-year rolling asset value to the university.

The new CIO has

engaged an investment consultant to assist her with the investment policy

review. The investment consultant has provided the following 10-year (nominal)

expected return assumptions for various asset classes: US equities: 7%, Non-US

equities: 8%, US Treasuries: 2%, hedge funds: 5%, private equity: 10%. In

addition, the investment consultant believes that the endowment could generate

an additional 50 bps in alpha from active management in equities. Expected

inflation for the next 10 years is 2%.

The new CIO was at

a previous endowment that invested heavily in private investments and hedge

funds and recommends a change in the investment policy to the board of Ivy

University Endowment.

She recommends

investing 30% in private equity, 30% in hedge funds, 30% in public equities

(15% US and 15% non-US with active management), and 10% in fixed income. This

mix would have an expected real return of 5.1% based on the expected return

assumptions provided by the investment consultant.

Should the board approve the new CIO’s recommendation? Provide your reasoning.

选项:

解释:

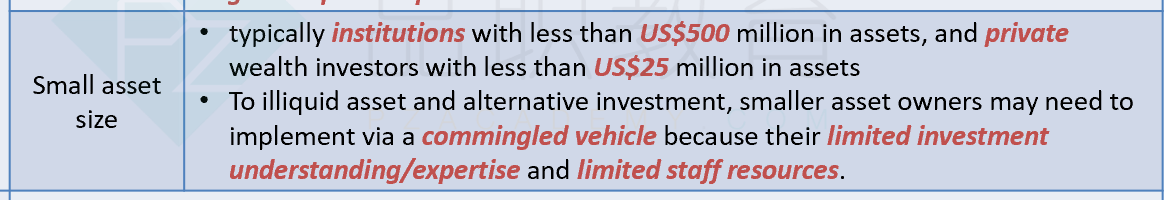

The board should reject the CIO’s recommendation. This is a very significant departure from the current practice. The size of the investment team is small, and they have no prior experience in managing hedge fund and private equity portfolios (except for the new CIO). Given the size of the endowment, it is unlikely to have access to top quartile managers in the hedge fund and PE spaces.

老师好,本题认为250million asset size是small的。

想问下多大的asset size是large?这个算默认的条件吗?