NO.PZ202207040100001004

问题如下:

Arthur Camme Case Scenario

Arthur Camme, founder of Camme Consulting, Inc., advises endowment funds and private foundations regarding equity manager selection. Because of the poor relative performance and high fees of active management over the past several years, Camme has been fielding an increasing number of inquiries from clients about the best ways to use passive solutions for equity exposure.

Camme meets with client Sylvia Parker, who seeks guidance in establishing passive exposure for her $400 million family foundation. For a portion of equities, Parker wants to use an index approach augmented by factor-based solutions. She comments, “I hear that factor-based approaches can be used when pursuing risk-adjusted returns superior to that of a comparable market cap-weighted index. In addition,

fundamental weighting can enhance return, but when compared with intrinsic values, it has the disadvantages of overweighting overpriced stocks and underweighting underpriced stocks;

value factor funds seek to lower downside risk; and

relative to cap weighting, single-factor funds tend to concentrate risk exposure.”

Camme suggests to Parker that the first priority in moving to a passive solution is to consider the choices available for index exposure. Owing to the large size of the fund, Camme recommends choosing a replication manager in order to minimize total costs. He explains the differences between full replication, stratified sampling, and optimization when constructing the portfolio. Parker likes the idea of blending stratified sampling with optimization and asks Camme to identify the appropriate manager based on the data in Exhibit 1.

Exhibit 1

Equity Replication Managers

In reviewing the relative performance of Manager B from Exhibit 1, Parker makes the following statements:

He faced more volatile markets than the others did, based on the tracking errors.

He used currency overlays to lever the returns of securities held in foreign currency.

His excess return looks like it is more a matter of luck than skill.

Another client is Ken Dashe, the new chairman of the investment committee of the Daventown Arts Endowment. He wants Camme to help him understand the primary investment strategy being followed by the MultiFAK fund, which uses several factors to structure and maintain its large-cap active portfolio. The fund uses benchmark segments of four mutually exclusive sub-categories as shown in Exhibit 2.

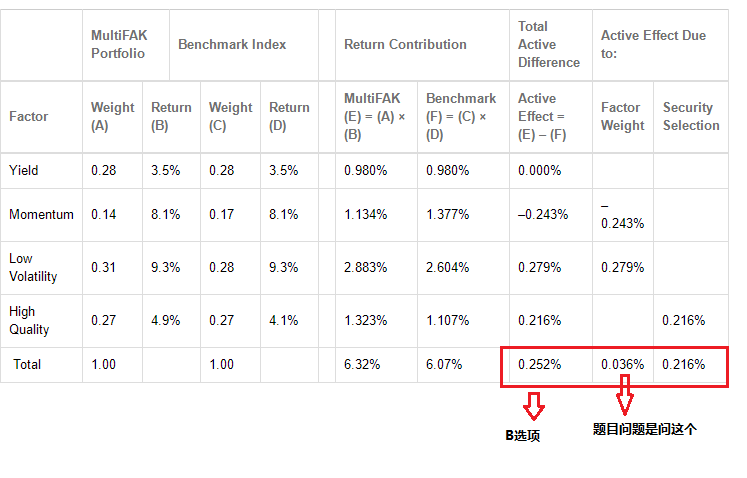

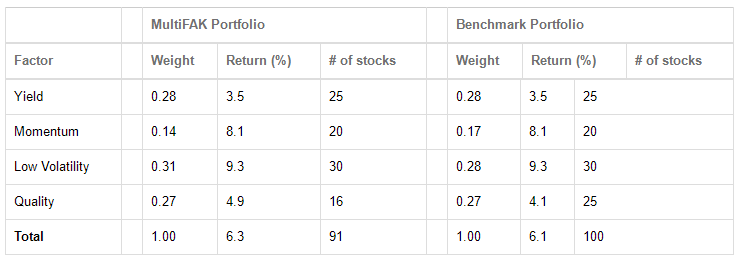

Exhibit 2

Attribution Data for MultiFAK Fund and Benchmark

At Dashe’s request, Camme calculates the amount of the excess return of MultiFAK that arose from active factor weighting decisions.

Due to a recent fund raising campaign, Daventown experienced sizable cash inflows and the funds were applied in accordance with policy weights.

Exhibit 3

Excerpts from Daventown Arts Endowment Investment Policy Statement

Several months later, Dashe and Camme meet again. Dashe needs advice on how to handle a new pressing issue. A significant market correction has resulted in a current asset allocation of 51% equities, 2% cash, and 47% fixed income. These values are now inconsistent with the investment policy statement guidelines. In addition, the tracking error with equity benchmarks has increased because of a disproportional decline in values of some of the actively managed funds. Camme recommends a cost-efficient strategy to address the situation that will put the portfolio back in line with allocation guidelines and reduce the tracking error.

Question

Based on Exhibit 2, the excess return of MultiFAK arising from active factor weighting is closest to:

选项:

A.0.04%. B.0.25%. C.0.28%.解释:

Solution

A is correct. The excess return arising from active factor weights is 0.04%. Compare the weights between the portfolio and the index: The only two that differ are the weights for Low Volatility and Momentum. From the following table, the total contribution to the return caused by active sector weighting is the sum of

0.28% Overweighting Low Volatility + (–0.24%) Underweighting Momentum = 0.04% rounded.

Note that MultiFAK used fewer holdings for the Quality segment and, therefore, incurred active security selection risk—but not active factor risk since the Quality segment weight is the same as that of the index. Here is the full calculation:

0.036% rounds to 0.04%.

B is incorrect. Results of all active management are shown at the bottom of the Total Active Difference column of the table. This is the full attribution of the active segment overweights plus the result of the active security selection on the Quality segment.

C is incorrect. This is the value of the active overweight to the Low Volatility segment, but it excludes the active underweight to Momentum. See the Low Volatility row in the Factor Weight column of the table.

如题