问题如下图:

选项:

A.

B.

C.

发亮_品职助教 · 2018年06月06日

一般计算含权债券的价值,就是从期末开始,用One-year forward rate,将债券现金流往前一年折现,看看前一年债券是否被行权;如果行权,就将债券的价格调整到行权价,然后加上本期的coupon继续往前折现;重复上面的步骤,直至折现到现在求出PV。

再用二叉树折现求现值时,由于一个节点会分2支叉,导致往上一个节点折现时,会有两个情况,所以折现值要求加权平均。

本题给的不是二叉树利率,而是确定的One-year forward rate,所以直接折,不用求加权平均。

按题目给的信息:Bond 4是一个maturity 3年,每年都可以用Par value被提前赎回的callable bond。

所以需要确定:每一年年末的时候,债券的价格是否会触发行权价。即需要用每一年的One-year forward rate,将上一年的债券价值折现到本期。所以折现时,用到的是one-year forward rate。

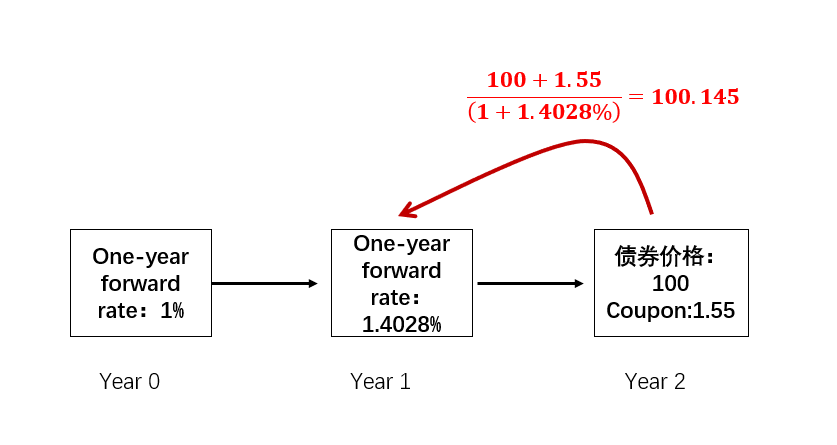

从第三年年末开始,将债券到期面额,加上第三年的Coupon折现到第二年末,用到的折现率是第二年末的One-year forward rate:

发现第二年末的债券价格为100.1952大于行权价100,所以第二年末触发行权,将债券价格调整到100。

然后继续将第二年末调整后的债券价格100加上Coupon折现到第一年末,用到的折现率是第一年末开始的One-year forward rate:

发现触发行权价,将第一年末的债券价格调整到100,加上第一年的coupon,往现在时刻折现,折现率是现在起的one-year forward rate:

所以,callable bond的现值是100.545

同理求出来option-free bond的PV,不过option-free不用对比是否行权。

Jerry · 2019年03月18日

请问是我们自己假设callable在年尾行权,还是题目中哪里给了?谢谢

发亮_品职助教 · 2019年03月18日

一般假设在年尾行权,除非有特殊说明,题目没说的话就是默认在年末行权。然后题目一般会说是在哪几年行权,所以有个可能是一个5年期债券,行权的机会只有2次,例如只有第四年和第三年年末有行权机会,其他时间没有,这点也要关注下。

NO.PZ201712110200000304 问题如下 Baseon the information in Exhibit 1 anExhibit 2, the value of the embeeoption in Bon4 is closest to: A.nil. B.0.1906. C.0.8789. C is correct. Bon4 is a callable bon Value of issuer call option = Value of straight bon– Value of callable bon The value of the straight bonmcalculateusing the spot rates or the one-yeforwarrates.Value of option-free (straight) bonwith a 1.55% coupon using spot rates:1.55/(1.0100)1 + 1.55/(1.012012)2 + 101.55/(1.012515)3 = 100.8789.The value of a callable bon(par) with no call protection periocannot excee100, thprior higher the bonwoulcalle The value of the call option = 100.8789 – 100 = 0.8789. 这道题V-straight_bon一开始是用SPOT RATE,从第三期往前折算(二叉树方法,只是不用分叉计算),发现出来结果是101.1742和答案100.8788不一样。然后我用forwarrate算一次发现结果就是100.8788,由此联想到,请问二叉树中各期利率是不是forwarrate? 我一直理解为SPOT RATE

NO.PZ201712110200000304 问题如下 Baseon the information in Exhibit 1 anExhibit 2, the value of the embeeoption in Bon4 is closest to: A.nil. B.0.1906. C.0.8789. C is correct. Bon4 is a callable bon Value of issuer call option = Value of straight bon– Value of callable bon The value of the straight bonmcalculateusing the spot rates or the one-yeforwarrates.Value of option-free (straight) bonwith a 1.55% coupon using spot rates:1.55/(1.0100)1 + 1.55/(1.012012)2 + 101.55/(1.012515)3 = 100.8789.The value of a callable bon(par) with no call protection periocannot excee100, thprior higher the bonwoulcalle The value of the call option = 100.8789 – 100 = 0.8789. callable bon价格有上限,不能超过100,所以,callable bonvalue应该是100,这句话怎么理解呢

NO.PZ201712110200000304 问题如下 Baseon the information in Exhibit 1 anExhibit 2, the value of the embeeoption in Bon4 is closest to: A.nil. B.0.1906. C.0.8789. C is correct. Bon4 is a callable bon Value of issuer call option = Value of straight bon– Value of callable bon The value of the straight bonmcalculateusing the spot rates or the one-yeforwarrates.Value of option-free (straight) bonwith a 1.55% coupon using spot rates:1.55/(1.0100)1 + 1.55/(1.012012)2 + 101.55/(1.012515)3 = 100.8789.The value of a callable bon(par) with no call protection periocannot excee100, thprior higher the bonwoulcalle The value of the call option = 100.8789 – 100 = 0.8789. embeoption bon以不考虑路径,用forwarrate求价值吗。。。

NO.PZ201712110200000304 问题如下 Baseon the information in Exhibit 1 anExhibit 2, the value of the embeeoption in Bon4 is closest to: A.nil. B.0.1906. C.0.8789. C is correct. Bon4 is a callable bon Value of issuer call option = Value of straight bon– Value of callable bon The value of the straight bonmcalculateusing the spot rates or the one-yeforwarrates.Value of option-free (straight) bonwith a 1.55% coupon using spot rates:1.55/(1.0100)1 + 1.55/(1.012012)2 + 101.55/(1.012515)3 = 100.8789.The value of a callable bon(par) with no call protection periocannot excee100, thprior higher the bonwoulcalle The value of the call option = 100.8789 – 100 = 0.8789. 但是我的疑惑是每次折现用什么数据,答案这里是spot rate进行折现,我却用了额one-yeforwar行折现,就是每次不知道用哪个数字合理?

NO.PZ201712110200000304 问题如下 Baseon the information in Exhibit 1 anExhibit 2, the value of the embeeoption in Bon4 is closest to: A.nil. B.0.1906. C.0.8789. C is correct. Bon4 is a callable bon Value of issuer call option = Value of straight bon– Value of callable bon The value of the straight bonmcalculateusing the spot rates or the one-yeforwarrates.Value of option-free (straight) bonwith a 1.55% coupon using spot rates:1.55/(1.0100)1 + 1.55/(1.012012)2 + 101.55/(1.012515)3 = 100.8789.The value of a callable bon(par) with no call protection periocannot excee100, thprior higher the bonwoulcalle The value of the call option = 100.8789 – 100 = 0.8789. The value of a callable bon(par) with no call protection periocannot excee100, thprior higher the bonwoulcalle为什么不会是小于100呢?没有赎回时间限制的callable bon什么一定价值是100呢?