NO.PZ2023040401000093

问题如下:

If an underlying asset’s price is less than a related option’s strike price at expiration, a protective put position on that asset versus a fiduciary call position has a value that is:

选项:

A.lower.

the same.

higher.

解释:

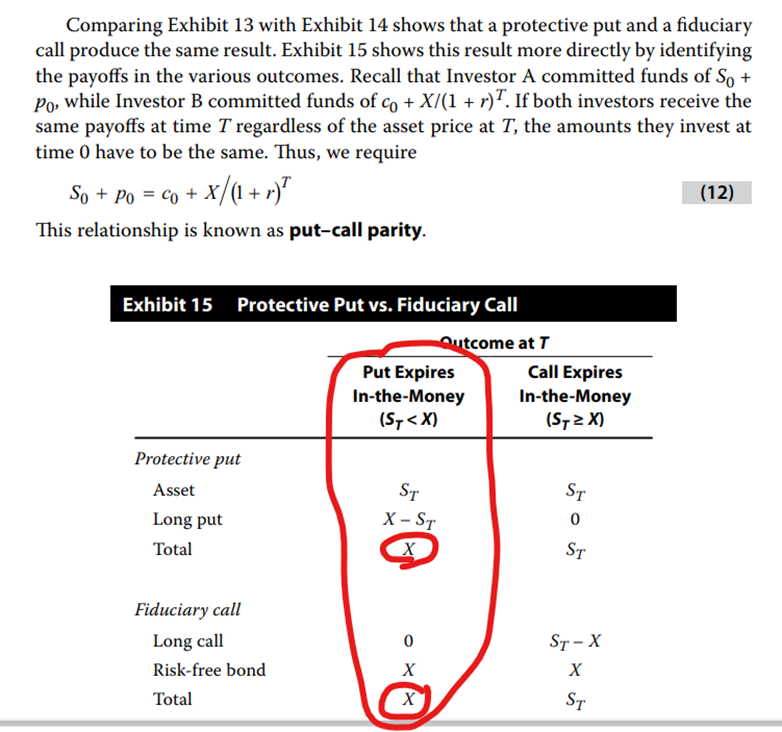

B is correct. On

the one hand, buying a call option on an asset and a risk-free bond with the

same maturity is known as a fiduciary call. If the fiduciary call expires in

the money (meaning that the value of the call, ST – X, is greater

than the risk-free bond’s price at expiration, X), then the total value of the

fiduciary call is (ST – X) + X, or ST. On the other hand,

holding an underlying asset, ST, and buying a put on that asset is

known as a protective put. If the put expires out of the money, meaning that

the value of the asset, ST, is greater than the put’s value at

expiration, 0, then the total value of the protective put is ST – 0,

or ST. A protective put and a fiduciary call produce the same

result.

解析没明白,可以再解释一下吗