NO.PZ2023010903000069

问题如下:

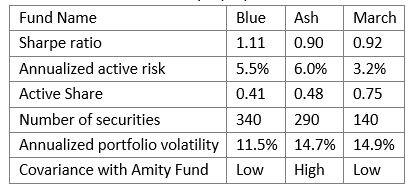

Another of Langham’s clients, Marianne Quint, sits on the investment committee of the Amity Island Endowment. The $2 billion equity portion of the Amity fund is invested using a global equity index approach. Quint has been charged with identifying an active equity fund to replace 20% of the indexed portfolio. Three candidate funds with similar performance histories, benchmarks, and fees have been identified. Based on the characteristics shown in Exhibit 3, Quint asks Langham to recommend the fund that has demonstrated the best risk-efficient delivery of results.

Exhibit 3 Characteristics of Candidates for Amity Equity Portfolio

选项:

A.Ash

Blue

March

解释:

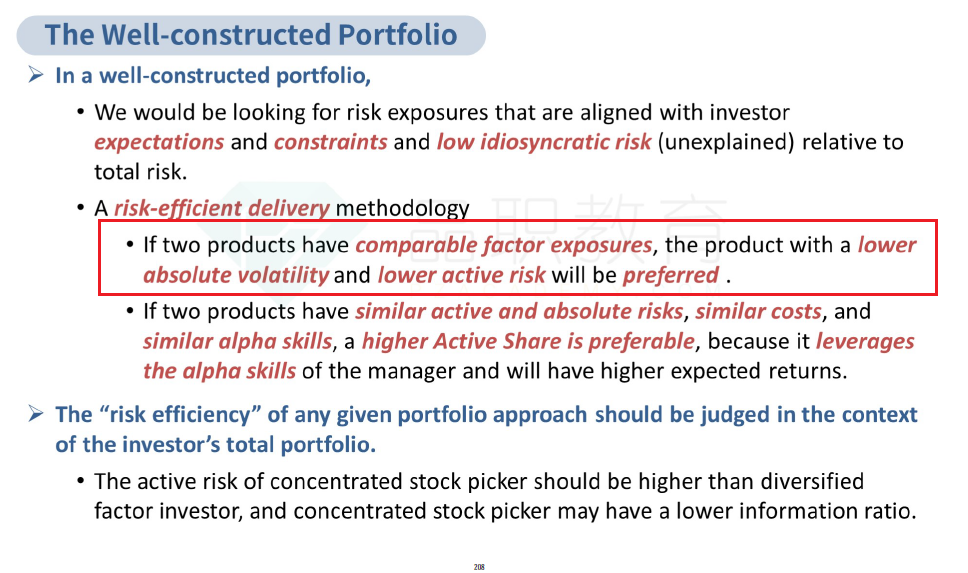

The March Fund is the fund that is most consistent with Quint’s requirements for the best risk-efficient delivery of results. It delivers the lowest active risk (3.2%) using far fewer securities (140), indicating an efficient approach. The higher Active Share (0.75) for the similar level of fees also supports this decision.

A is incorrect. Ash has the highest active risk, which indicates active return contributions of a greater dispersion than the benchmark and the competing funds. More securities and lower Active Share are not supportive of this fund choice.

B is incorrect. Blue has the highest number of securities and a relatively low Active Share. Although the overall portfolio volatility is the lowest of the three (producing a higher Sharpe ratio), the more relevant risk is that attributable to active management. Greater active risk despite more securities is not the most efficient method.

如题。结合本题,相同active share下,active risk越小,不就是主动性越差,越和BM很像么,这为什么反而是更risk efficient?