NO.PZ2019120301000187

问题如下:

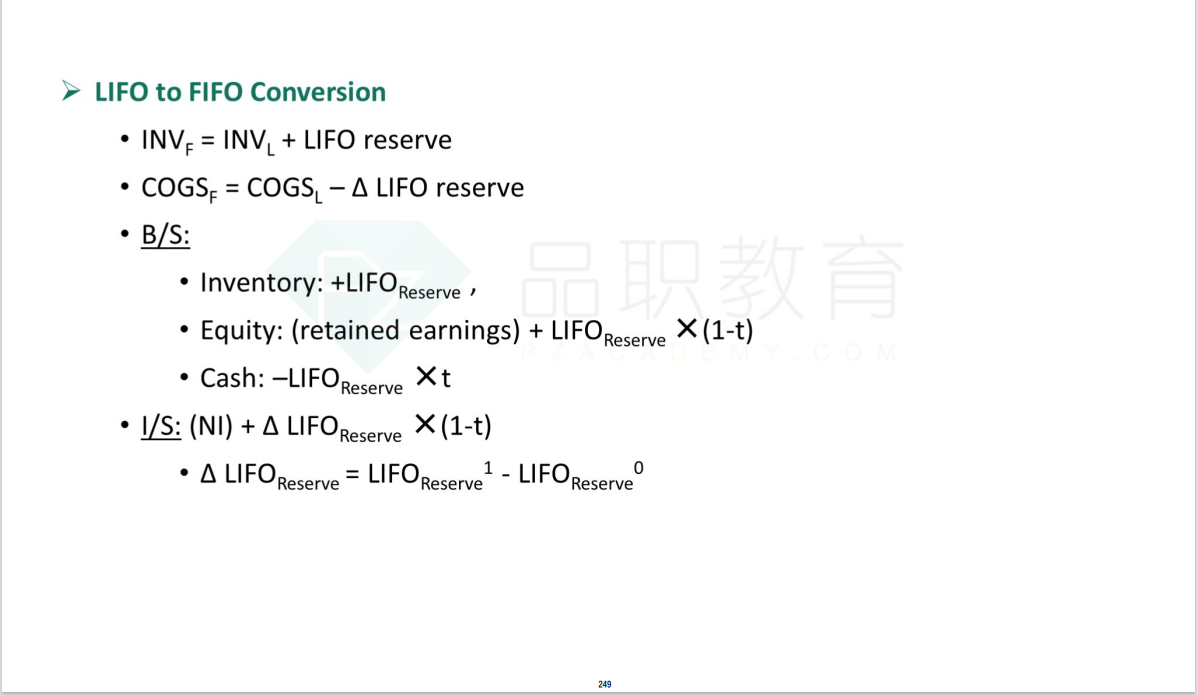

Question A company using the last-in, first-out (LIFO) inventory method reports a year-end LIFO reserve of $85,000, which is $20,000 lower than the prior year. If the company had used first-in, first-out (FIFO) instead of LIFO in that year, its financial statements would most likely have reported:选项:

A.a higher cost of goods sold (COGS) but a lower inventory balance. B.both a higher cost of goods sold (COGS) and a higher inventory balance. C.a lower cost of goods sold (COGS) but a higher inventory balance.解释:

Solution

B is correct.

A is incorrect. As per the table, inventory would be higher.

C is incorrect. As per the table, COGS would be higher.

用逻辑推断,FIFO先进先出使得COGS增加那肯定是以前的存货比现在贵才能使得COGS增加啊,那以前的存货出掉了,留下来的是现在的存货,肯定便宜啊,怎么可能同增同减?