NO.PZ202206140600000402

问题如下:

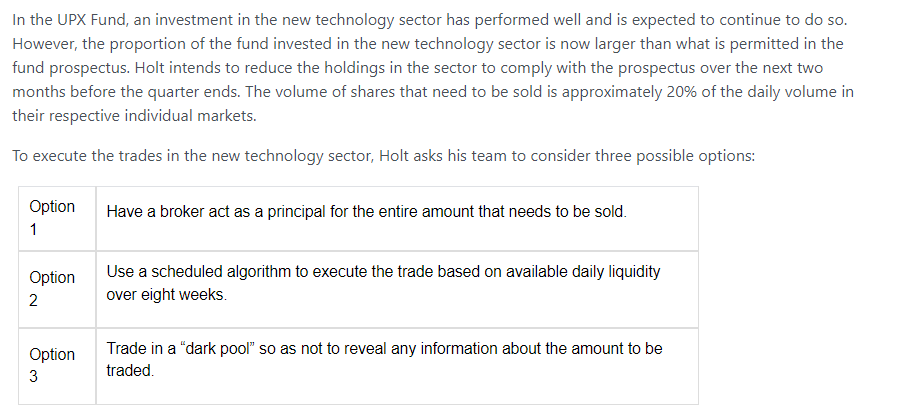

Which trading option is most appropriate for selling securities from the new technology sector of the UPX Fund?选项:

A.Option 1 B.Option 2 C.Option 3解释:

SolutionB is correct. A scheduled algorithm over the eight-week period is the best option for selling the securities. There is sufficient liquidity in the market, because on any given day, the amount sold will be approximately 0.5% of the daily volume: 20% daily volume ÷ (5 days × 8 weeks) = 0.5%. The price impact of trading will be minimal, and there is no trade urgency given the time horizon for liquidating the shares.

A is incorrect. Given that the trade can be executed over a two-month period, there is no reason to incur the expense of having a broker act as a principal trader for all the shares. If there were a need to trade the shares quickly, this kind of strategy could be warranted.

C is incorrect. A dark pool is more appropriate when a given trade can reveal valuable information about the security being traded. In this case, the trading has no information value and needs to eventually be fully executed; in addition, a dark pool does not guarantee execution.

A是说找个broker虽然可以交易出去但是需要额外一笔费用么

C是说Dark pool可能交易不出去,也没有额外的特别信息reveal么

且B的交易量占市场份额不多?

、、

、、