NO.PZ2023041003000058

问题如下:

Burr asks Madisox to

outline an appropriate hedging strategy. Madisox replies that to be fully

hedged, an option trader will need to consider how changes in the stock price

relative to the option exercise price affect the value of the call options. To

be fully hedged against a small change in the stock price, Madisox suggests

that the proper strategy to construct the hedge is to use call option delta and

add the call option gamma to arrive at the number of shares required.

Is

Madisox’s suggested hedging strategy for Weehawkin options most likely correct?

选项:

A.Yes

No, he should only use delta.

No, he should subtract gamma.

解释:

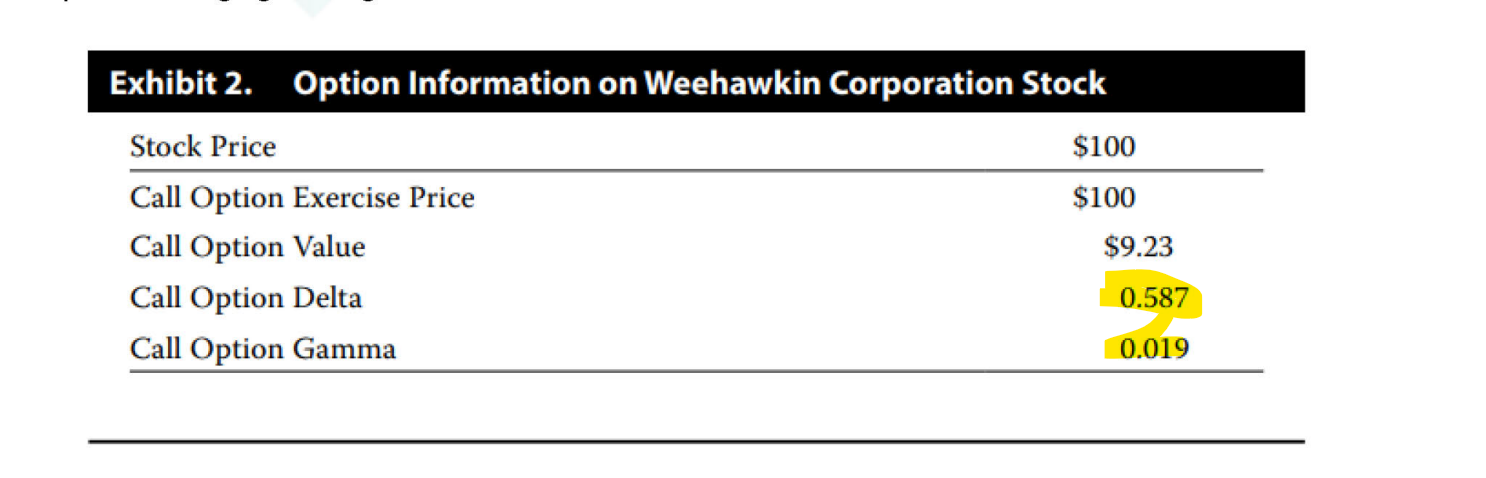

Madisox’s statement

is correct. To be fully hedged against a small change in the stock price, the

proper strategy to construct the hedge is to use call option delta and add the

call option gamma to arrive at the number of shares required. The number of

shares required is 0.606, based on the option delta of 0.587 plus the option

gamma of 0.019.

B is incorrect. To be

fully hedged against a small change in the stock price, the proper strategy to

construct the hedge is to use call option delta and add the call option gamma to

arrive at the number of shares required.

C is incorrect. You

need to add, not subtract, option gamma to the option delta.

老师,您好!

To be fully hedged against a small change in the stock price, the proper strategy to construct the hedge is to use call option delta and add the call option gamma to arrive at the number of shares required.

这句该怎么理解?

The number of shares required is 0.606, based on the option delta of 0.587 plus the option gamma of 0.019.

这里的数字是怎么得来的? 麻烦老师讲解一下,谢谢!