NO.PZ2023040501000141

问题如下:

Spaulding tells Tomlinson that she believes the quality of earnings has deteriorated and that the recent increase in profitability is the result of earnings management. In support, she presents several ratios in Exhibit 3.

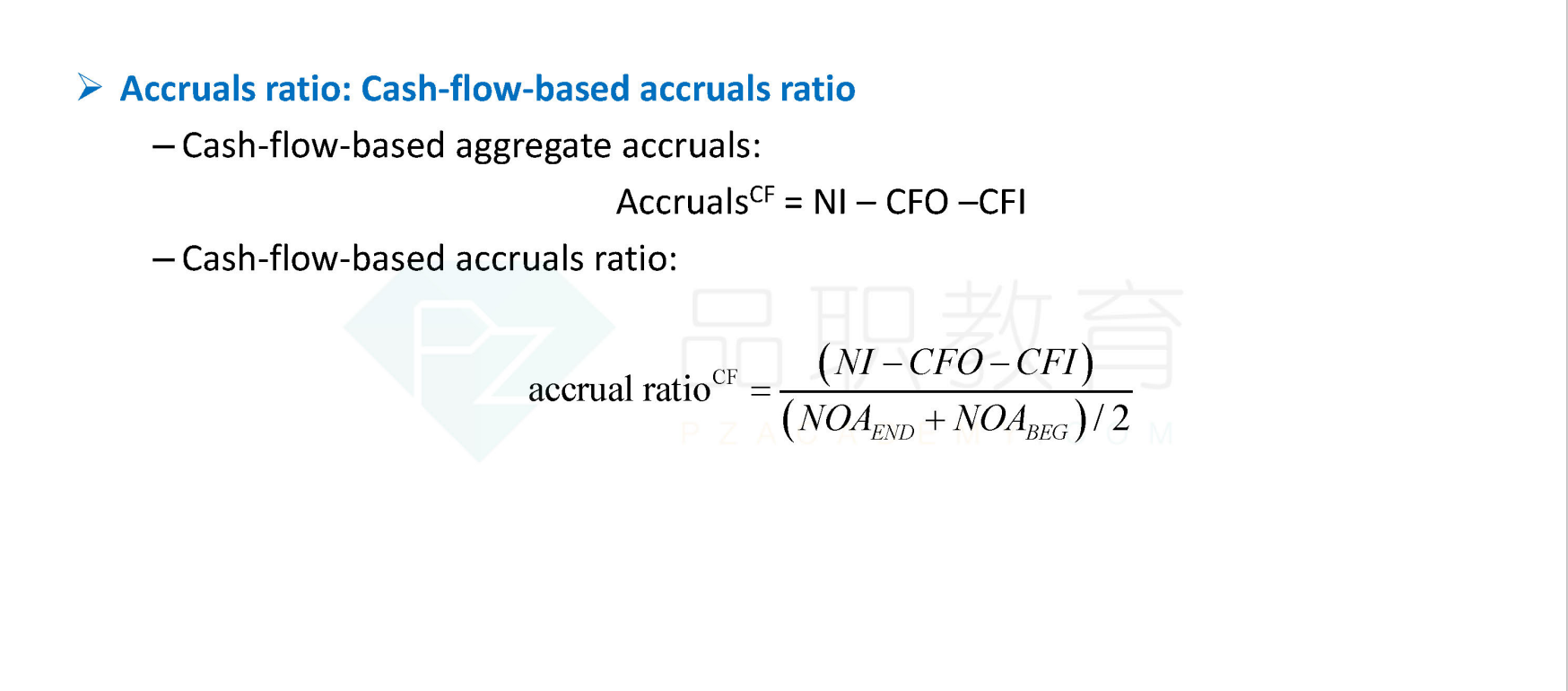

Spaulding goes on to say that after preparing Exhibit 3, she also determined the cash flow based accruals ratios for the two years and suspects that the accruals portion of earnings has increased.

Tomlinson responds:

“The ratios you have provided for operating cash flow to operating income are overestimates to what they would have been if operating cash flows had been calculated on a pre-tax and pre interest basis.”

Based on their discussion surrounding Exhibit 3, which of the following statements is most appropriate?

选项:

A.Tomlinson’s comment about the operating cash flow to operating income ratio is correct.

According to Spaulding, the cash flow based accrual ratio was lower in 2014 than in 2013.

According to Spaulding, the persistence of the company’s earnings has deteriorated.

解释:

Earnings with a lower component of accruals are more persistent and are of higher quality. Based on Spaulding’s statement that the accruals portion of earnings has increased, the persistence of earnings has deteriorated and the earnings quality has declined.

这道题的整个分析流程不明白,会用到accrual ratio的CF的公式去分析吗