NO.PZ2018070201000094

问题如下:

Tim, an analyst of an investment company forecasts the return and deviation of below securities. Based on these information, which statement is most correct:

选项:

A.

Security A has the least amount of market risk.

B.

Security B has the least amount of market risk.

C.

Security C has the least amount of market risk.

解释:

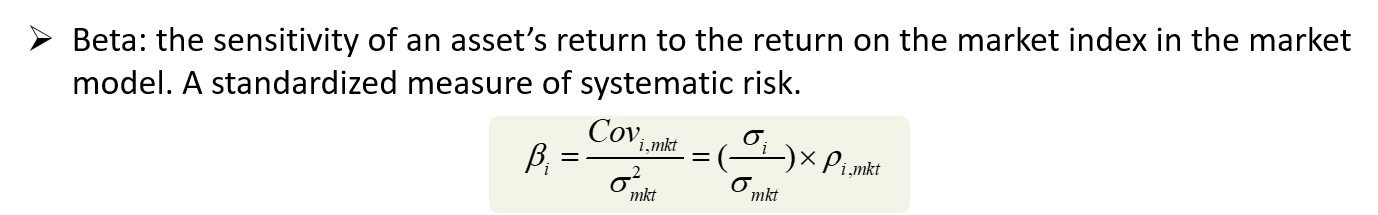

B is correct.

The beta value of security A is1.4

The beta value of security B is 1.33

The beta value of security C is1.5

Security B has the lowest beta value, therefore, it has the lowest amount of market risk.

market risk为什么用B算