NO.PZ2023020602000030

问题如下:

Which of the following transactions would most likely be reported below income from continuing operations, net of tax?选项:

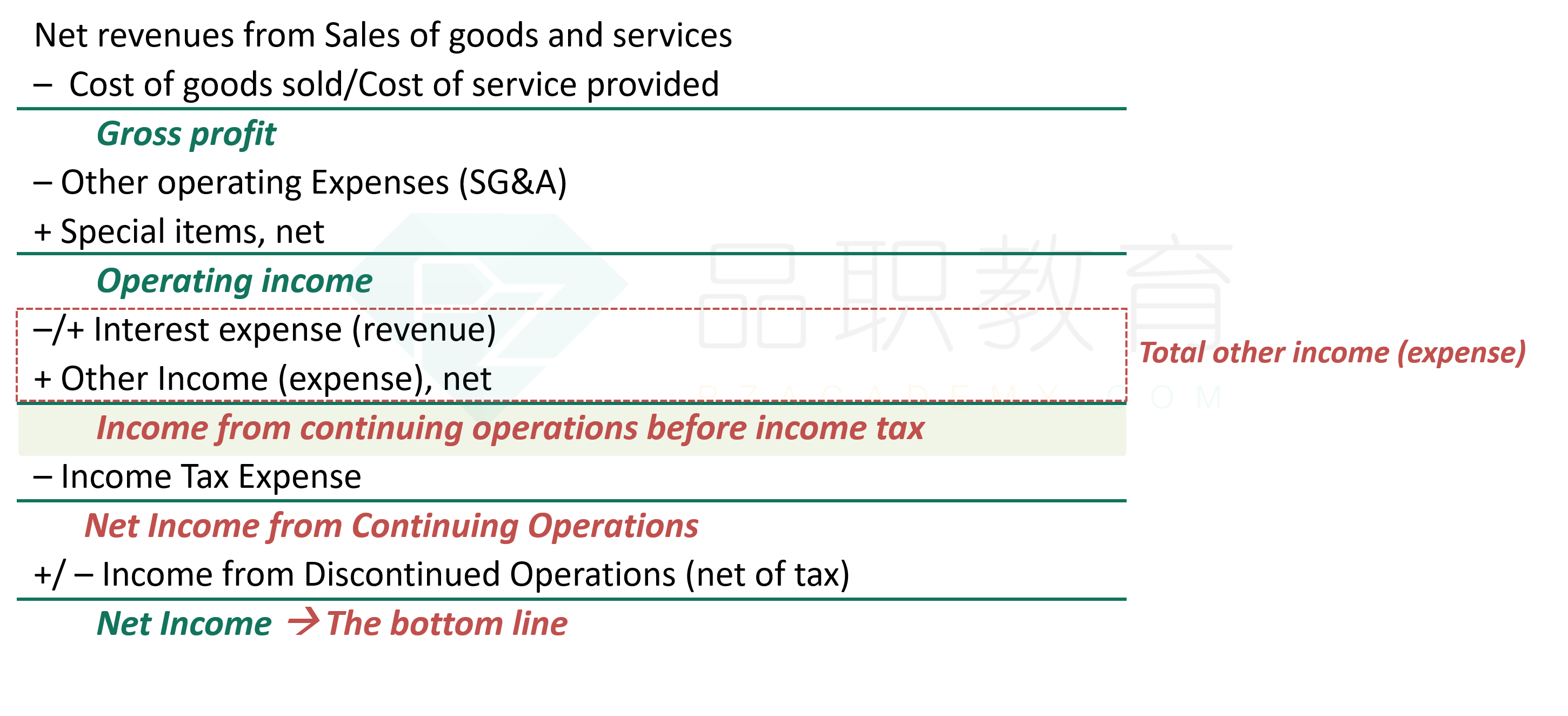

A.Gain or loss from the sale of equipment used in a firm's manufacturing operation. B.A change from the accelerated method of depreciation to the straight-line method. C.The operating income of a physically and operationally distinct division that is currently for sale, but not yet sold.解释:

A physically and operationally distinct division that is currently for sale is treated as a discontinued operation. The income from the division is reported net of tax below income from continuing operations. Changing a depreciation method is a change of accounting principle, which is applied retrospectively and will change operating income.不理解题目的意思。