NO.PZ2023040501000006

问题如下:

Dagmar AG is a European-based manufacturing firm that prepares its financial statements according to International Financial Reporting Standards (IFRS). Two members of Dagmar’s treasury group, Henrik Ferdinand and Adele Christoph, are reviewing Dagmar’s portfolio of investments.

The contribution from the investment in Alme to Dagmar’s net earnings (in thousands) for 2017 is closest to:

选项:

A.€222.

€234.

€200.

解释:

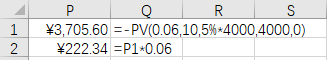

The investment in Alme was classified as held to maturity. Therefore, Dagmar would use amortized cost as the method to account for the investment, and the effect on net earnings would be the interest revenue earned for the year at the effective market rate at the time of purchase by Dagmar (6%).

The interest revenue (in thousands) for 2013 can be calculated:

Market rate at issue × Book value at the beginning of the year (see supporting calculations for the book value): 6.0% × €3,705.6 = €222.3

哼哧哼哧算了半天,大概是算出来了?