NO.PZ2023010903000066

问题如下:

Before hiring Välimaa, the Missipina Foundation’s portfolio had been managed internally.

Välimaa reviews a memo from Missipina’s investment committee that summarizes the previous internal manager’s approach to portfolio construction:

“The manager used a growth at a reasonable price (GARP) investment approach to identify attractively priced stocks. He emphasized understanding a firm’s governance structure, management quality, business model/competitive landscape, and environmental, social, and governance (ESG)-related attributes. The portfolio generally held less than 60 stocks, significantly less than the number of stocks in the benchmark and the portfolio was not well diversified.”

Determine, based solely on the memo’s content, the previous manager’s two approaches to portfolio construction (bottom-up or top-down / systematic or discretionary). Justify each response.

Determine, based solely on the memo’s content, whether the former manager’s portfolio would most likely be characterized as having high or low:

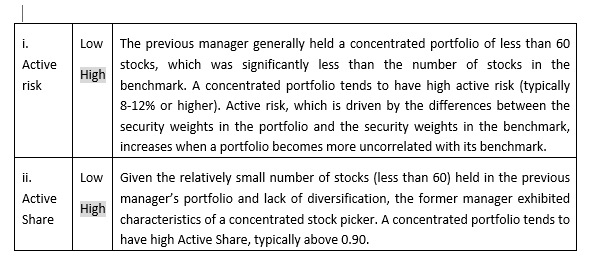

i. Active risk

ii. Active Share

Justify each response.

选项:

解释:

所以是不是说明他的目的不是为了用少量的股票去模拟benchmark的表现,而是调好的去买,然后创造更高的收益,所以return的表现和benchmark肯定有比较大的不同,所以active risk会比较高这样更好呢