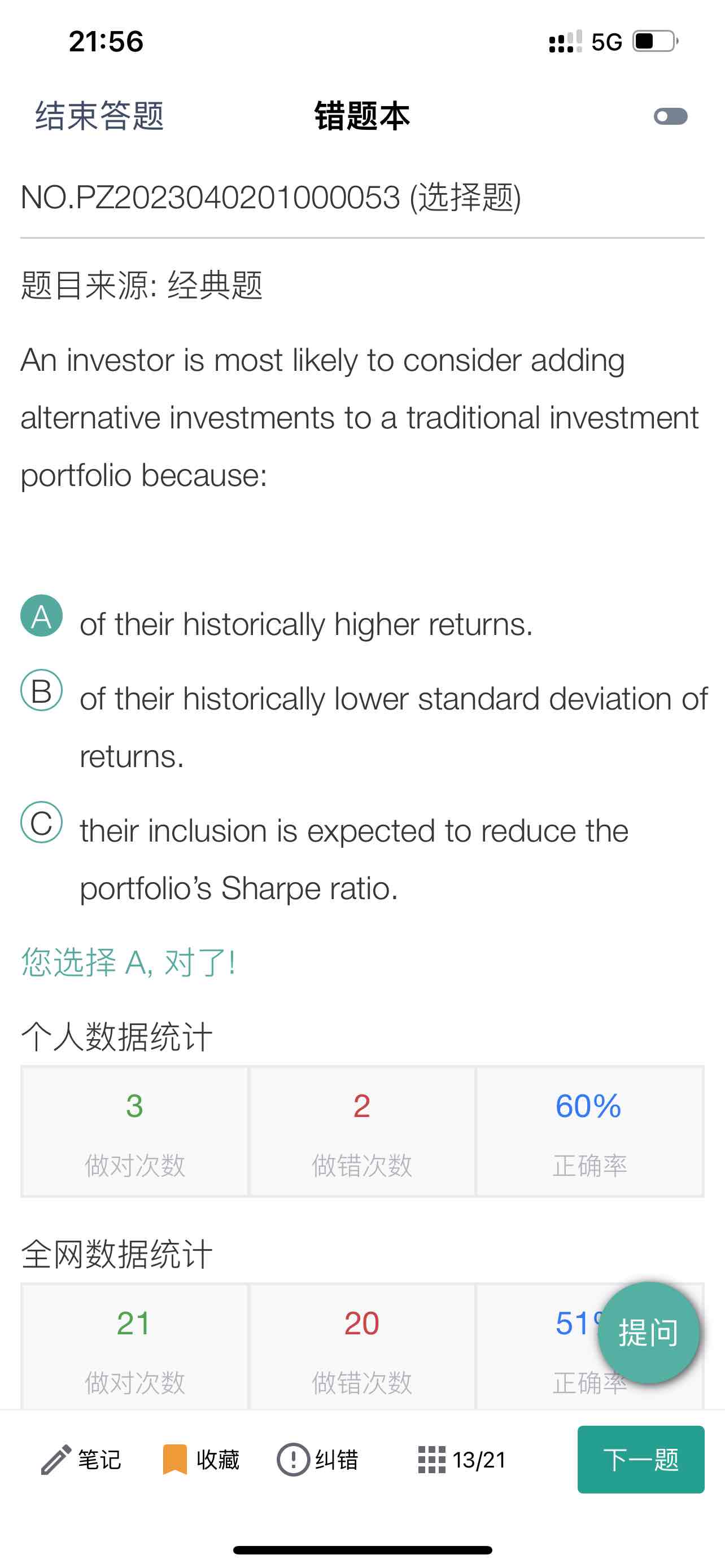

NO.PZ2023040201000053

问题如下:

An investor is most likely to consider adding alternative investments to a traditional investment portfolio because:

选项:

A.of their historically higher returns.

B.of their historically lower standard deviation of returns.

C.their inclusion is expected to reduce the portfolio’s Sharpe ratio.

解释:

The historically higher returns to most categories of alternative investments compared with traditional investments result in potentially higher returns to a portfolio containing alternative investments. The less than perfect correlation with traditional investments results in portfolio risk (standard deviation) being less than the weighted average of the standard deviations of the investments. This has potential to increase the Sharpe ratio in spite of the historically higher standard deviation of returns of most categories of alternative investments.

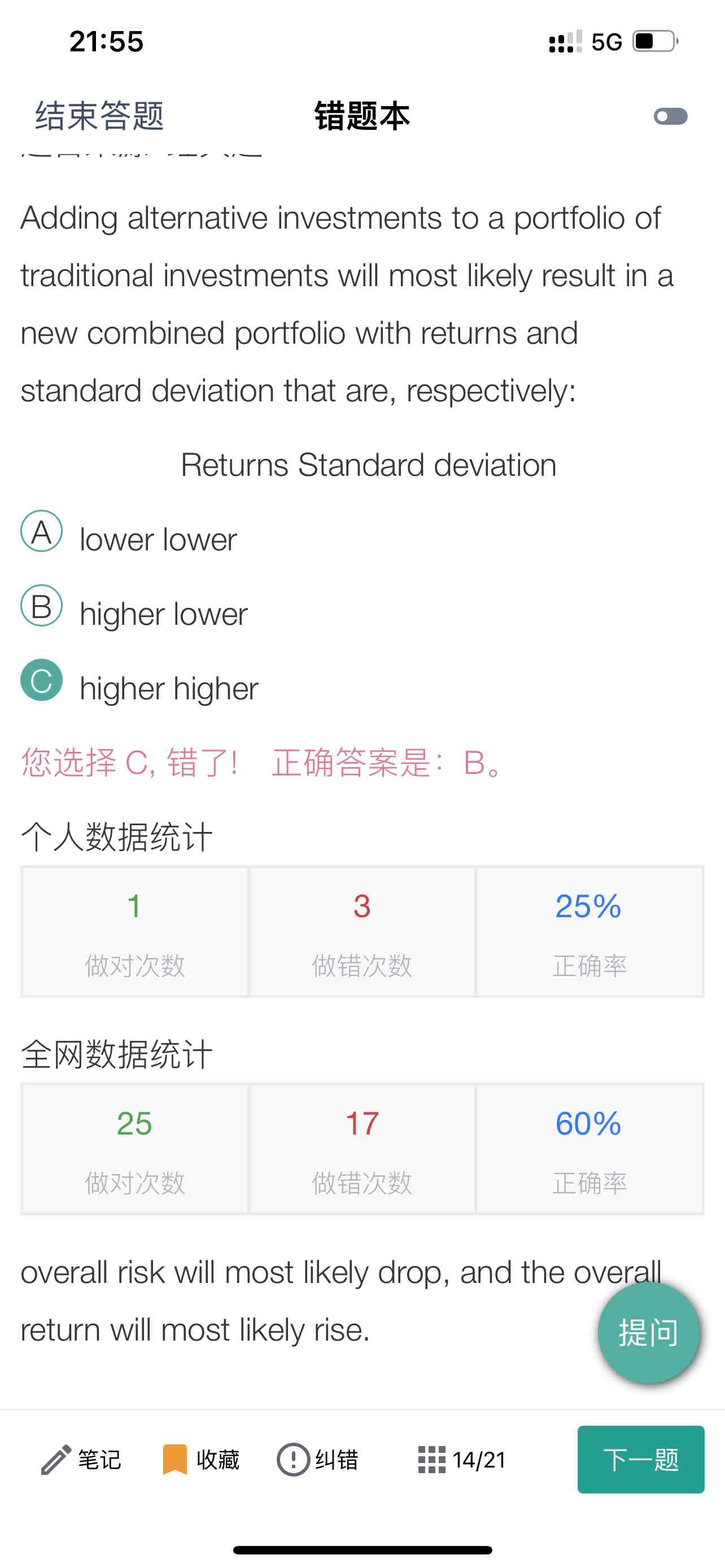

截图中的两个题目似乎矛盾了,另类投资自身的风险到底是高还是低?加入后的组合的sharp ratio的分子和分母各自如何变化,但是sharp ratio变高了?