NO.PZ202206260100000503

问题如下:

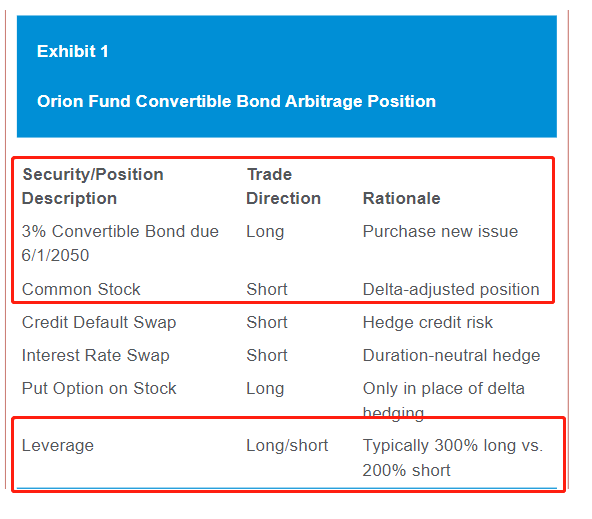

Based on the data in Exhibit 1, what strategy is the Orion portfolio manager most likely implementing?

选项:

A.Taking advantage of option mispricing

B.Profiting from extreme market volatility

C.Going long a put on the equity net of hedging

解释:

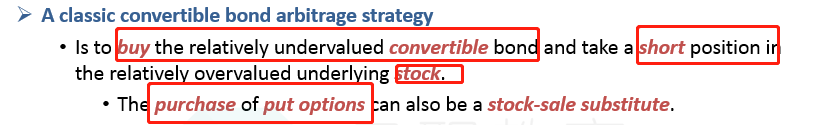

SolutionA is correct. To access and extract the relatively cheap embedded optionality of the convertible, the manager hedges away other risks that are embedded in the convertible security. These include interest rate risk, credit risk, and market risk. These risks can be hedged using a combination of interest rate derivatives, credit default swaps, and short sales of an appropriate delta-adjusted amount of the underlying stock or, alternatively, the purchase of put options.

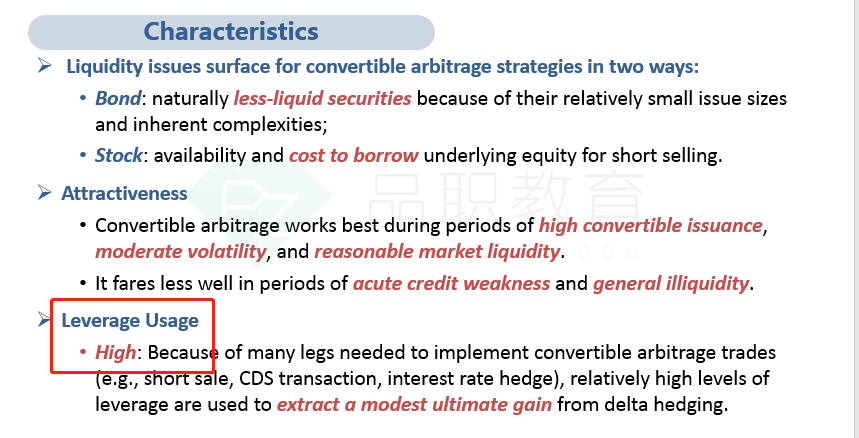

B is incorrect because the convertible arbitrage strategy performs best when there is modest volatility. Heightened volatility would suggest a period of illiquidity and widening credit spreads.

C is incorrect because buying a convertible bond and delta hedging the position does not equate to a long put position.

为什么可以达到A的效果啊,long bond+call+short stock,怎么把mispricing的option隔离出来