NO.PZ202212270100005301

问题如下:

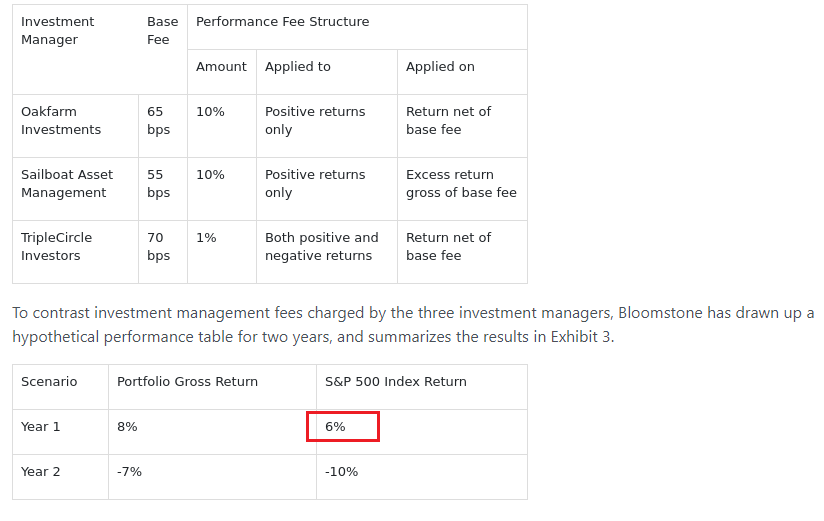

If Sailboat Asset Management generates the exact return shown in Exhibit 3, Year 1, its total investment management fee for Year 1 is closest to:

选项:

A.75 bps.

55 bps.

60 bps.

解释:

Correct Answer: A

Investment management fee = Base fee + Performance fee

Sailboat Asset Management charges a base fee of 55 bps and a performance fee of 10% on excess return. (Excess returns = Strategy return – Benchmark return)

Year 1 gross excess return = 8% – 6%= 2%

Sailboat performance fee = 10% of 2% = 0.2%

Sailboat base fee = 55 bps = 0.55%

Sailboat total investment management fee = 0.55% + 0.2% = 0.75% = 75 bps.

老师,这道题里面这句话,我以为是超过base fee,也就是0.55%以上的部分,然后再按照10%来进行计算?

这里没有讲到超过index return呀?

要从哪里get到是用来减去6%呀?