NO.PZ202212300100013704

问题如下:

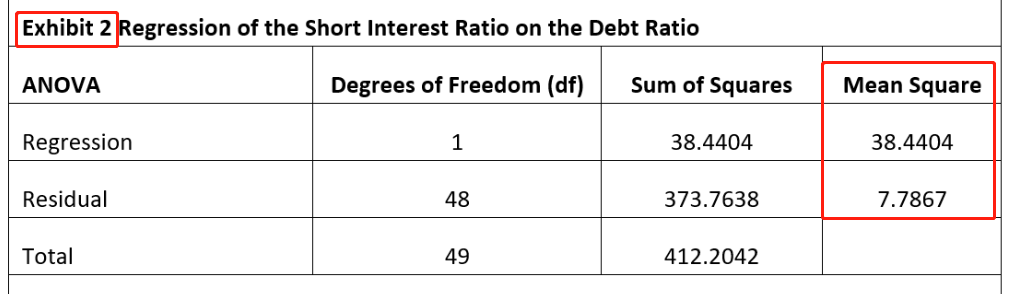

Anh Liu is an analyst researching whether a company’s debt burden affects investors’ decision to short the company’s stock. She calculates the short interest ratio (the ratio of short interest to average daily share volume, expressed in days) for 50 companies as of the end of 2016 and compares this ratio with the companies’ debt ratio (the ratio of total liabilities to total assets, expressed in decimal form). Liu provides a number of statistics in Exhibit 1. She also estimates a simple regression to investigate the effect of the debt ratio on a company’s short interest ratio. The results of this simple regression, including the analysis of variance (ANOVA), are shown in Exhibit 2.

Liu is considering three interpretations of these results for her report on the relationship between debt ratios and short interest ratios:

Interpretation 1 Companies’ higher debt ratios cause lower short interest ratios.

Interpretation 2 Companies’ higher short interest ratios cause higher debt ratios.

Interpretation 3 Companies with higher debt ratios tend to have lower short interest ratios.

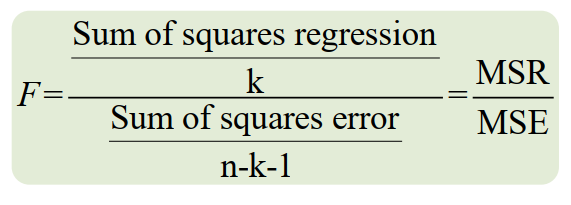

Based on Liu’s regression results in Exhibit 2, the F-statistic for testing whether the slope coefficient is equal to zero is closest to:

选项:

A.-2.2219

B.3.5036

C.4.9367

解释:

这题可以解答下吗?没看懂,以及知识点在哪