NO.PZ2018091705000084

问题如下:

Jacques purchases a US$100,000 face value whole life policy has an annual premium of US$2,000, paid at the beginning of the year. Policy dividends of US$500 per year are anticipated, payable at year-end. A cash value of US$32,500 is projected for the end of Year 30. Jacques has a life expectancy of 30 years and a discount rate of 5%. The net payment cost index that Jacques calculate is closest to:

选项:

A.$17.22.

B.$16.89.

C.$15.24.

解释:

C is correct.

考点: Net payment cost index

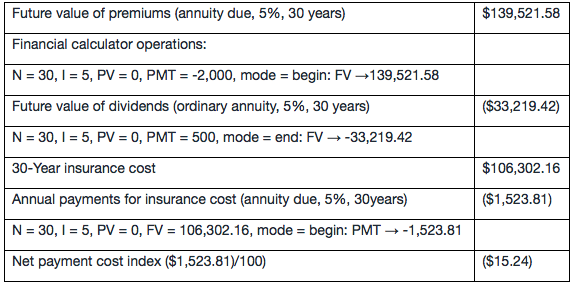

解析: The net payment cost index假设被保险人在30年后死亡。计算net payment cost index包括以下步骤:

按基础班PPT304的解题步骤:

FV of premium=139521.58,

FV of dividend=33219.42

30-year cash value=32500

相减后得30-year insurance cost=73802.16

再用上面这个数字作为FV求PMT得annual payments=1110.83

所以Index=11.11.

以上是根据基础班例题的步骤做的,为什么错了?题目答案中为何没有使用cash value 32500?