NO.PZ201805280100000402

问题如下:

The Fordhart portfolio has a market value

of $2 billion. After his annual meeting

with its investment committee, DuBord notes

the following points:

■ Fordhart must spend 3% of its

beginning-of-the-year asset value annually to meet legal obligations.

■ The investment committee seeks exposure

to private equity investments and requests that DuBord review the CFQ Private

Equity Fund as a potential new investment.

■ Enrollment is strong and growing, leading

to increased operating revenues from tuition.

■ A recent legal settlement eliminated an

annual obligation of $50 million from the portfolio to support a biodigester

used in the university’s Center for Renewable Energy. \

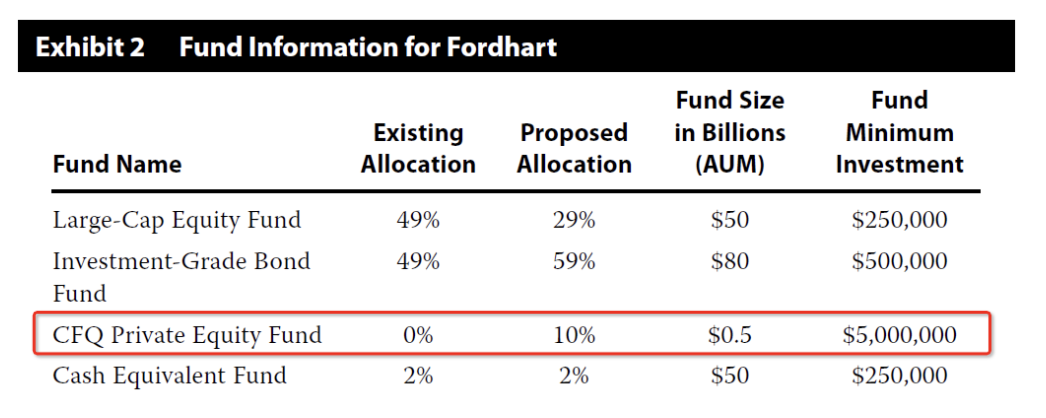

DuBord instructs his second junior analyst

to formulate new allocations for

Fordhart. This analyst proposes the allocation presented in Exhibit 2.

Discuss two reasons why the proposed asset

allocation is inappropriate for Fordhart.

选项:

解释:

The proposed asset allocation for Fordhart

is inappropriate because:

1 Given the increasing enrollment trends

and recent favorable legal settlement, Fordhart will likely require lower

liquidity in the future. The proposed allocation shifts Fordhart’s portfolio

away from risky assets (decreases the relative equity holdings and increases

the relative bond holdings).

2 The proposed 10% allocation to private

equity creates an overly concentrated position in the underlying investment. A

10% allocation to the CFQ Private Equity Fund is $200 million (10% of

Fordhart’s $2 billion). The CFQ Private Equity Fund has assets under management

(AUM) of $500 million. Hence, Fordhart would own 40% of the entire CFQ Private

Equity Fund. This position exposes both Fordhart and the CFQ fund to an

undesirable level of operational risk.

请问fund size in billion这一列代表什么?另外fund minimum investment没有写单位,PE应该是5m而不是500m吧,那么The CFQ Private Equity Fund has assets under management (AUM) of $500 million又是怎么来的呢?