NO.PZ2022122701000022

问题如下:

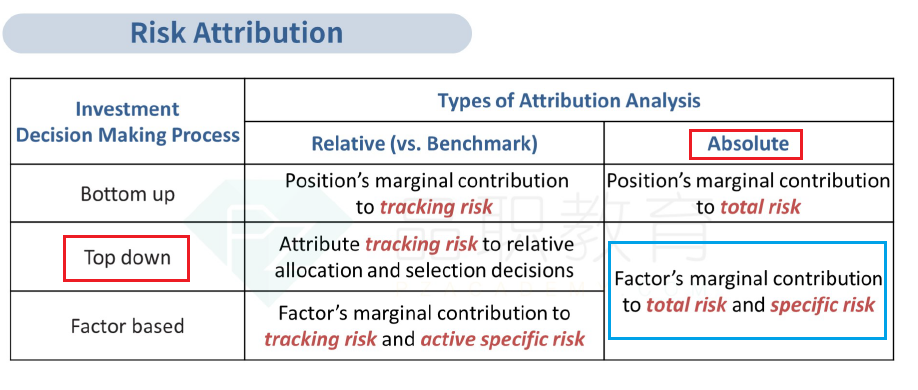

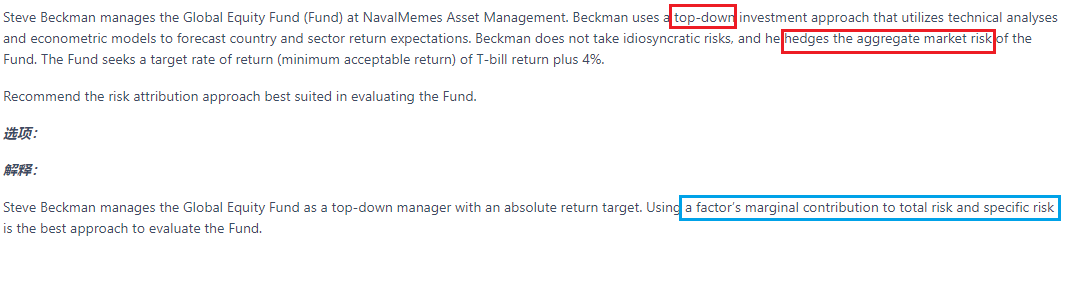

Steve Beckman manages the Global Equity Fund (Fund) at NavalMemes

Asset Management. Beckman uses a top-down investment approach that utilizes

technical analyses and econometric models to forecast country and sector return

expectations. Beckman does not take idiosyncratic risks, and he hedges the

aggregate market risk of the Fund. The Fund seeks a target rate of return

(minimum acceptable return) of T-bill return plus 4%.

Recommend the risk

attribution approach best suited in evaluating the Fund.

选项:

解释:

Steve Beckman

manages the Global Equity Fund as a top-down manager with an absolute return

target. Using a factor’s marginal contribution to total risk and specific risk

is the best approach to evaluate the Fund.

这个和approach里的specific risk有关系吗,需要说因为fund没有承担idiosyncratic risks所以不需要attribute factor‘s marginal contribution to specific risk吗