NO.PZ2022120703000091

问题如下:

Which of the following statements about ESG portfolio optimization is most accurate?

选项:

A.ESG portfolio optimization via constraints applies a fixed decision on specific securities B.Portfolios that optimize for a combination of ESG absolute data and subjective rankings minimize active risk to achieve both targets C.Optimizations with a targeted ESG exposure that requires tighter constraints may result in an increase in deviation from an optimal portfolio解释:

C is correct because "it is important to understand that targeted exposure that requires tighter constraints may likely result in an increase in deviation from an optimal portfolio."

A is incorrect because "ESG optimisation via constraints distinguishes itself from exclusionary screening in that it does not apply a fixed decision on specific securities. Rather, it is organising the securities by their individual ESG profile to solve a specific ESG optimisation at the overall portfolio level not on specific securities".

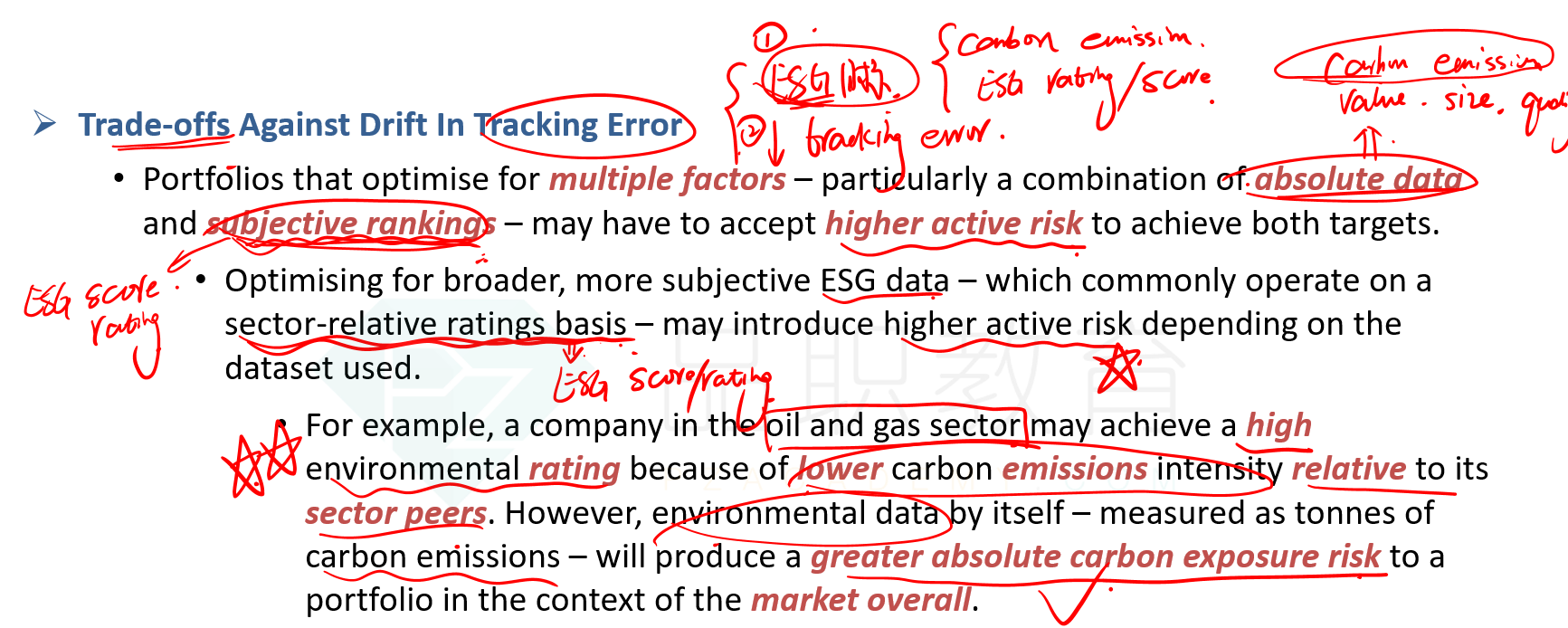

B is incorrect because "not surprisingly, portfolios that optimize for multiple factors – particularly a combination of absolute data and subjective rankings – may have to accept higher not lower active risk to achieve both targets."

老师,这个题如何理解呢,感觉每一个回答都很对。