NO.PZ2018103102000106

问题如下:

Two analysts are discussing about the characteristics of residual income models. Matt has forecasted that residual income per share will be constant into perpetuity. Mark questions Matt’s assumption regarding the implied persistence factor used in the multistage RI valuation. He believes that a persistence factor of 0.35 is appropriate. Compared to Mark`s assumption, Matt`s persistence factor will lead to:

选项:

A.higher multistage value estimate

B.lower multistage value estimate

C.the same multistage value estimate

解释:

A is correct.

考点:Multistage Residual Income Model

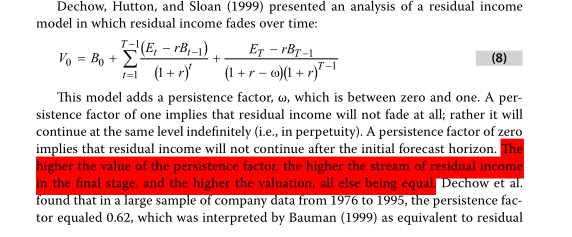

解析:Matt的模型中,持续因子为1,代表未来RI并不会衰减。Mark的模型中,持续因子为0.35。RI多阶段模型中,persistence factor持续因子越大,最后一阶段RI的净现值就会越大,所估计的权益内在价值也会越大。

我的理解是:RI(t-1) * (1+g)= RIt

公式中PVRI t-1= RI t-1*w/ 1+r-w

可以从第一个公式中得出,只要g小于零,RIt就是会比较低,可是分母中的折现1+r-w会影响最后的结果吗?分母越小最后的值越大,还是说因为分子的减小程度更多所以最后的PVRI t-1也会更小。

希望我表达明白,谢谢解答!