NO.PZ202212300200004902

问题如下:

Explain why each of the following option strategies is less appropriate than a straddle, given Jacob’s beliefs:

i. bull spread

ii. short butterfly spread

iii. zero cost collar

解释:

Correct Answer:

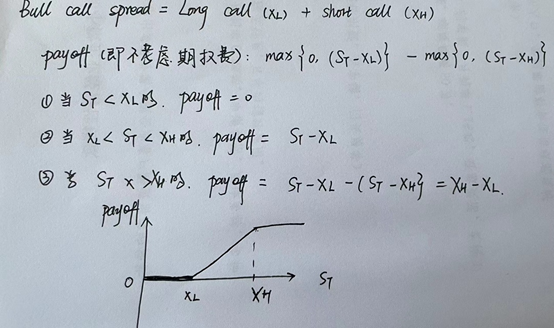

i. A bull spread

would lose money if the U.K. loses the bid and the share price falls sharply,

and would make only limited profits (compared to a straddle) if the U.K. wins

the bid and the share price appreciates sharply.

ii. A short

butterfly spread would make only limited gains when the share price either

increases or decreases beyond the breakeven points.

iii.

A zero cost collar would lose a limited amount of money if the U.K. loses the

bid, and would make only a limited profit (compared to a straddle) if the U.K.

wins the bid.

请老师讲一下这几个分别是怎么构建的