NO.PZ2022072902000011

问题如下:

Which of the following statements is true?

选项:

A.Sovereign debt is susceptible to distortion effects based on ESG ratings.

B.ESG is a standalone component within the entire investment process.

C.It is well understood that the long-term returns on equities outweigh the short-term risksassociated with the adoption of ESG by companies as well as funds.

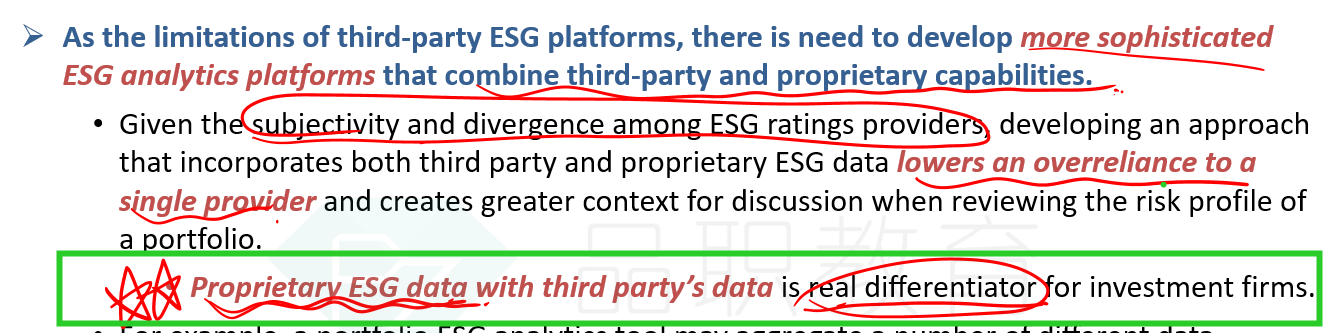

D.Proprietary ESG data is often a real differentiator for investment firms.

解释:

主权债务同样容易受到基于ESG评级的扭曲效应的影响。

B选项错误,ESG整合是嵌入到整个投资过程中的,并不是投资过程中的一个部分;

C选项错误,在组合层面整合ESG后的组合表现是否更优没有定论;

D选项错误,只用公司内部开发的ESG数据不足以与其他公司区分,正确的是结合公司内部开发的ESG数据和外部第三方数据,这样才是真正的differentiator。

D的结论是在第七章吗?