NO.PZ2019052801000039

问题如下:

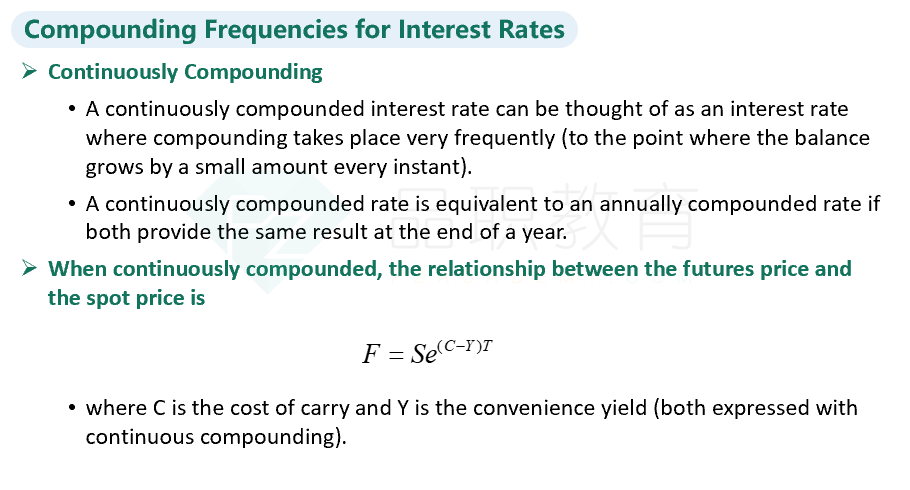

A farmer plans to sell 50,000 tons of soybeans in six months, he decides to short futures contracts to hedge against the price deline. The current price of soybeans is $ 508/ton, the contract size is 100 tons, the storage cost for the soybeans is 1.5% per year. The continuously compounded rate is 5%, what's the price for the futures contract ?

选项:

A.

$35412.

B.

$76634.

C.

$50217.

D.

$52478.

解释:

D is correct.

考点:远期合约定价

解析:

x100 tons per contract = $52478

cost的算法为什么不是508*1.5%/2 然后加上508再乘e^5%*0.5