NO.PZ2023032701000002

问题如下:

With respect to 2 Statements, which of the following measures of value would the distressed securities fund’s analyst consider that a core equity fund analyst might ignore?

Statement 1

“For its distressed securities fund, Guardian Capital screens its investable universe of securities for companies in financial distress.”

Statement 2

“For its core equity fund, Guardian Capital selects financially sound companies that are expected to generate significant positive free cash flow from core business operations within a multiyear forecast horizon.”

选项:

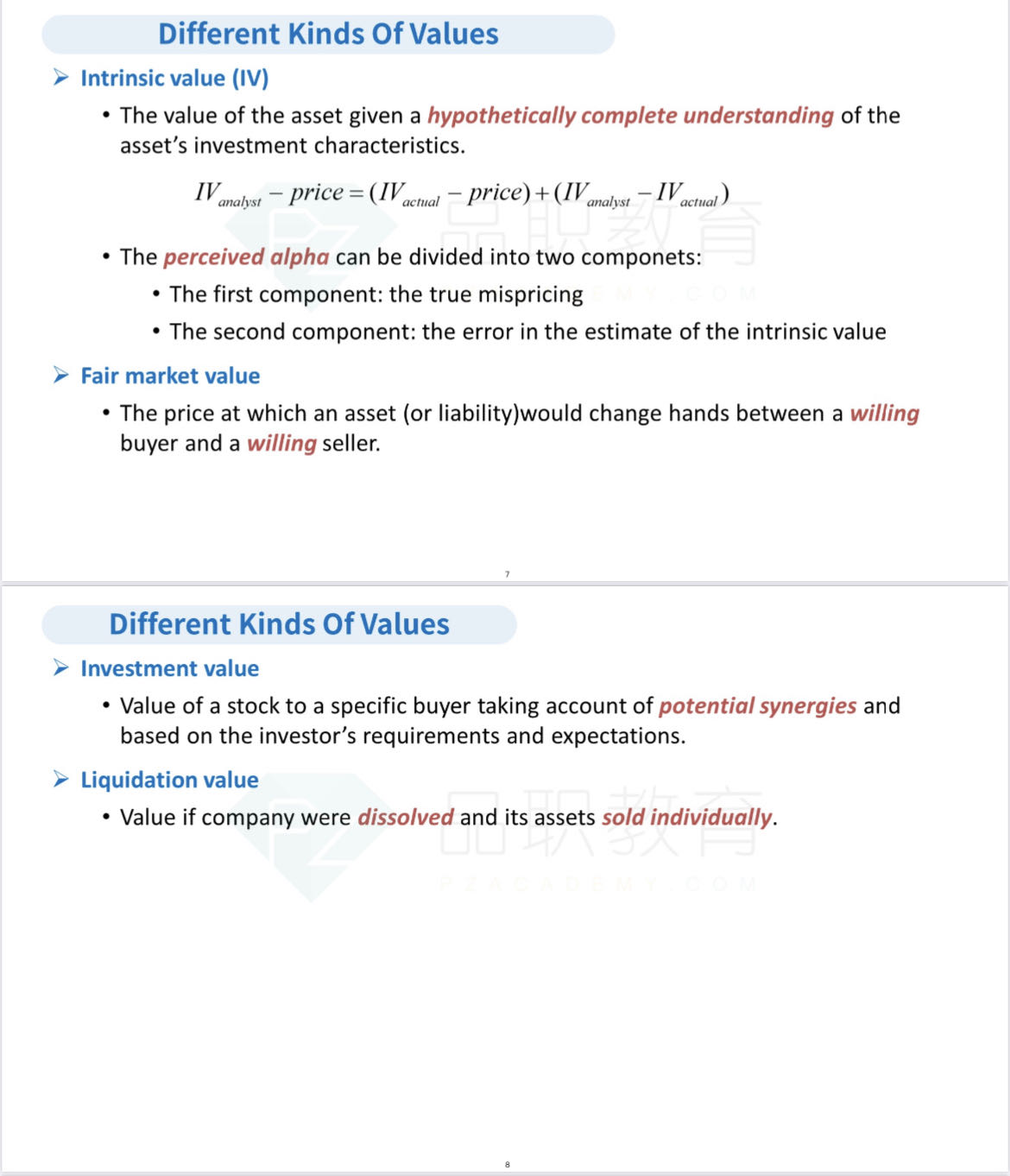

A. Fair value

Liquidation value

Fair market value

解释:

The measure of value the distressed securities fund’s analyst would consider that the core equity fund analyst might ignore is liquidation value. The liquidation value of a company is its value if it were dissolved and its assets sold individually

老师,您好!

题目中的distressed 该如何理解?fair value和fair market value理解上有何区分? 谢谢!