老师,这道题是Mock里的,2020年mock,我感觉李老师讲解时候的公式和讲义上课给的公式不一样

题目和问题如下:

Charles Bray is 75 years old, a widower with no offspring, and is in poor health. As part of a recent estate planning exercise following his retirement from Three Brothers, Charles liquidated nearly all of his assets, including his home, taxable accounts and retirement accounts. He purchased a series of inflation-indexed life annuities and a lifetime residency contract at an assisted living facility. These actions, coupled with a comprehensive health insurance plan, have resulted in all of Charles’s future living, spending and health care costs being covered.

When he was liquidating his assets, Charles only retained a single balanced fund in the amount of $3 million in a tax-exempt account. This is his only remaining financial asset. As he no longer has any future expenses, Charles would like to use this fund to benefit his deceased wife’s favorite niece.

Because of previous gifting, Charles has no tax credits or allowances available to shelter either future gifts or bequests from taxation. The tax rate that would apply to both gifts and bequests would be a flat 50% and the tax would be due immediately, payable by Charles or by his estate. The niece is in the same income tax bracket as Charles and the fund would earn the same rate of return whether held by Charles or the niece.

Charles asks Cheng whether he should gift the balanced fund to the niece now or leave it to her, including any interim reinvested appreciation, at his death. He wishes for her to receive the maximum possible economic benefit.

E. Determine whether Charles should gift or bequeath the assets to the niece and determine the financial advantage of the strategy chosen. [Note: No generation-skipping transfer tax would apply in this case.]

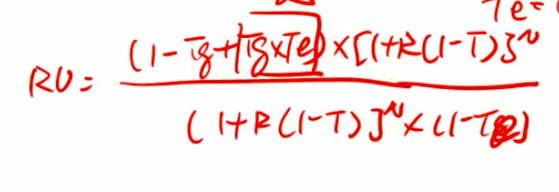

李老师讲解的公式:

李老师当时的讲解是分子里的【Tg*Te】有抵税的作用,但是讲义里并没有提到,是现在教材删掉了吗,考试遇到这种题目用哪个公式呢,谢谢老师