NO.PZ2023032701000078

问题如下:

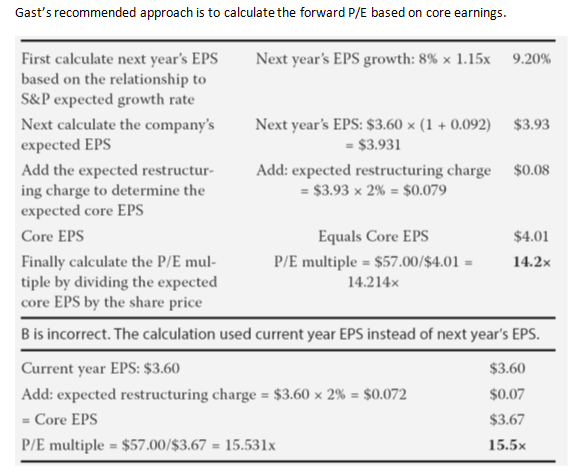

Gast asks Hughes to calculate the trailing and forward price/earnings multiples based on core earnings. Hughes uses the data in Exhibit 2 for his calculations for WPR.

S&P 500 expected EPS growth rate is 8%

Following Gast’s recommended approach, the forward P/E multiple that Hughes calculates for Western Plains Rail is closest to:

选项:

A.

14.2×

B.

15.5×

C.

14.5×

解释:

为什么是加上restructuring charge 而不是减去?