NO.PZ2022122601000071

问题如下:

Rachael Lyon is an analyst at an international investment firm. Using the Singer-Terhaar approach, Lyon estimates the risk premium for equities in the developed country of Edonia using data from Exhibit 1.

Calculate the risk premium for Edonia equities using the Singer-Terhaar approach. Show your calculations.

选项:

解释:

Correct Answer:

The risk premium on the Edonia equities is 6.1%, which is calculated in three steps.

Step 1: Risk premium of Edonia equities under full integration (RPEE, full int)

Step 2: Risk premium of Edonia equities under full segmentation (RPEE, full seg)

Step 3: Risk premium of Edonia equities (RPEE)

where,

RPEE, full int = Risk premium of Edonia equities under full integration (4.2%)

RPEE, full seg = Risk premium of Edonia equities under full segmentation (8.4%)

δ = degree of integration with GIM (given as 0.55)

中文解析:

Edonia股票的风险溢价为6.1%,分三步计算。

步骤1:完全整合下的Edonia股票风险溢价(RPEE, full int)

步骤2:全细分(RPEE,全细分)下东尼亚股票的风险溢价

第三步:Edonia股票的风险溢价(RPEE)

在那里,

印度卢比(RPEE) =完全整合下Edonia股票的风险溢价(4.2%)

RPEE,全分段= Edonia股票在全分段下的风险溢价(8.4%)

δ =与GIM的整合度(设为0.55)

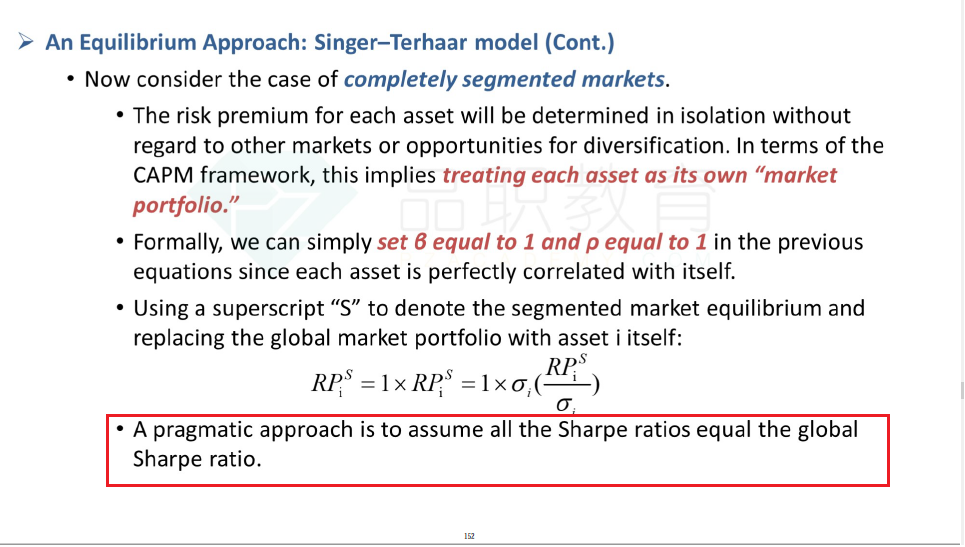

老师,在full segmentation的情况下,

答案里的解释,为啥还是用MARKET的△呢?

不是英国用的是△i的吗?那就应该是risk premium(GM)/△(E这个市场的吗?)

但是题目里,只给了GM的SR,是因为没有给所以就用这个代替了???没有道理的呀。。。

那是什么呢?