NO.PZ2023041004000074

问题如下:

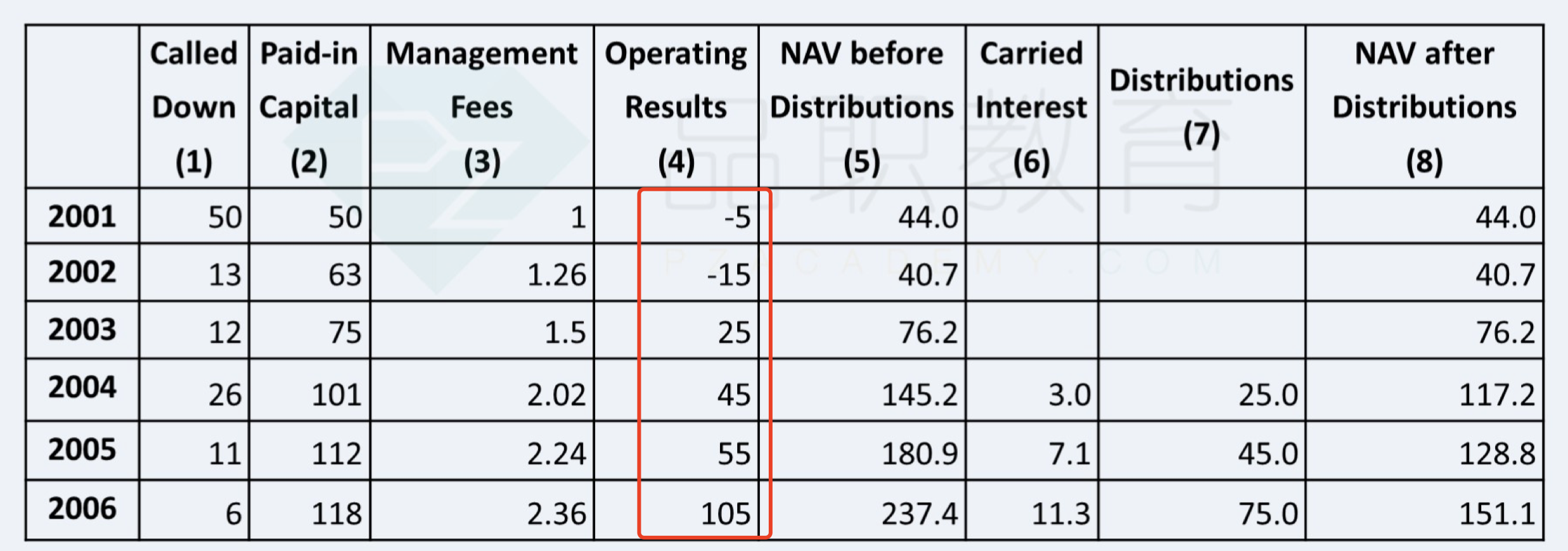

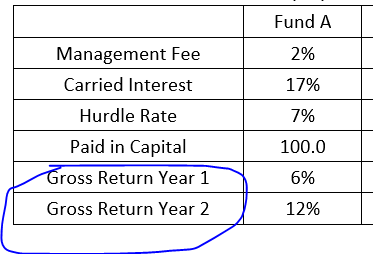

Snyder asks Clark to explain the general structure of a private equity fund. Clark replies by stating that the general partner of a private equity fund performs two primary functions: (1) raising capital and (2) managing the investment and exit of portfolio companies. The fee structure of a private equity fund is intended to align the interests of the general partner with the limited partners. Clark produces a table (Exhibit 1) that illustrates the fee structure and investment returns for three private equity funds. Each fund has a European distribution waterfall.

Based on Clark’s explanation of private equity fund structures and Exhibit 1, the fund which produced the highest net return over two years to its limited partners is most likely:

选项:

A.Fund A. B.Fund B. C.Fund C.解释:

For a private equity fund, a limited partners’ net return equals gross return minus management fees minus carried interest paid to the general partner. Fund C realized the highest net return for its limited partners since $0 of carried interest was paid to its general partner. The distribution waterfall for each fund is total return (European). Accordingly, the general partner’s carried interest is based on total returns. Although each fund produced an equal level of pre-carried interest return (gross return less management fees), Fund C did not earn its 10% hurdle rate. Therefore, the general partner for Fund C was not paid any carried interest, and 100% of the pre-carried interest return for Fund C was distributed to its limited partners. The pre-carried interest return for Funds A and B each exceeded the hurdle rate. Accordingly, the general partners of Fund A and Fund B both received carried interest, which reduced the return for the limited partners of Fund A and Fund B. Fund A offers the highest potential net return over the life of the fund to the limited partners since it has the lowest carried interest. Return Analysis

Hurdle rate

attained: Yes or No

Limited partners’

return = (Gross return – Management fees) –(Net return × Carried interest)

Fund C:

IRR = –100 + 10 +

108 = 9.04% < 10% Hurdle rate

Limited partners’

return = (10.0 + 8.0) – (100 × 2% × 2) – (14 × 0%) = 14.00

Fund A:

IRR = –100 + 6 +

112 = 8.87% > 7% Hurdle rate

Limited partners’

return = (6.0 + 12.0) – (100 × 2% × 2) – (14 × 17%) = 11.62

Fund B:

IRR = –100 + 8 +

10 = 8.96% > 8% Hurdle rate

Limited partners’

return = (8.0 + 10.0) – (100 × 2% × 2) – (14 × 18%) = 11.48

A is incorrect.

Fund C produces the highest return for the limited partners. Refer to explanation

for C.

B is incorrect.

Fund C produces the highest return for the limited partners. Refer to explanation

for C.

以fund a为例:

Fund A:

IRR = –100 + 6 + 112 = 8.87% > 7% Hurdle rate

Limited partners’ return = (6.0 + 12.0) – (100 × 2% × 2) – (14 × 17%) = 11.62

答案算的gross return是6+12.

但是现金流是期初-100,第一年收益6,第二年拿到112,也就是第二年的收益是112-106=6吧?为什么return会是6+12?

比如在下面这个表中,第一年的operating result就对应这里的6,那第二年的operating result在fund a中是多少?是6还是12?按答案就是12,但是这个12不是累计值麽?下面表格中的operating result是时点值吧?