NO.PZ2018122701000044

问题如下:

Under these assumptions - in particular: a flat yield curve and constant yield volatility of 1.0% - why can we expect cash flow mapping to produce a lower diversified VaR than either duration and principal mapping?

选项:

A.

The risk measures are non-linear.

B.

Due to imperfect correlations between pairwise risk factors.

C.

Fewer total cash flows will be mapped.

D.

We cannot expect a lower diversified VaR.

解释:

B is correct.

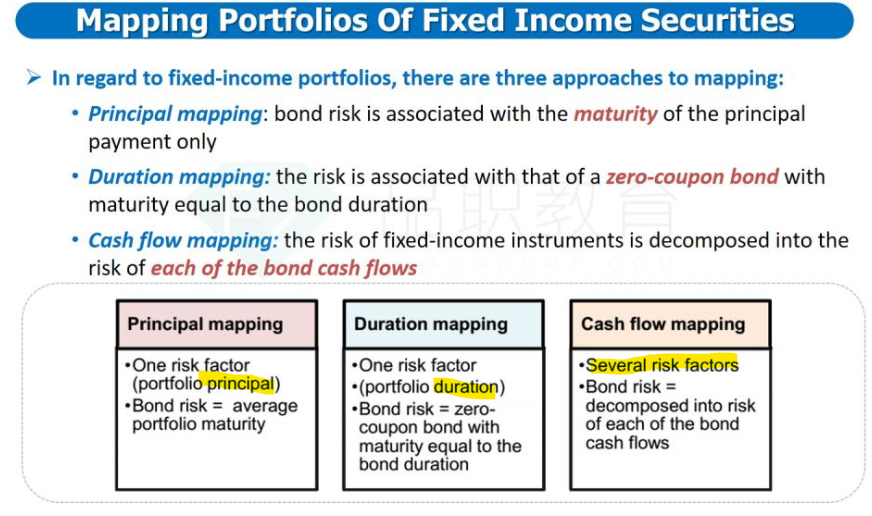

考点Mapping to Fixed Income Portfolios

解析The diversified VaR is lower due to two factors. First, risk measures are not perfectly linear with maturity. Second, correlations are below unity, which reduces risk even further.

老师好,请问这个b选项说的是后面会提到的component risk吗?然后还想问一下课堂上说的convexity是指三种mapping都会遇到的还是就第二种duration mapping跟麦考利久期有关才是呈现凸性呢?谢谢!