NO.PZ2022071105000014

问题如下:

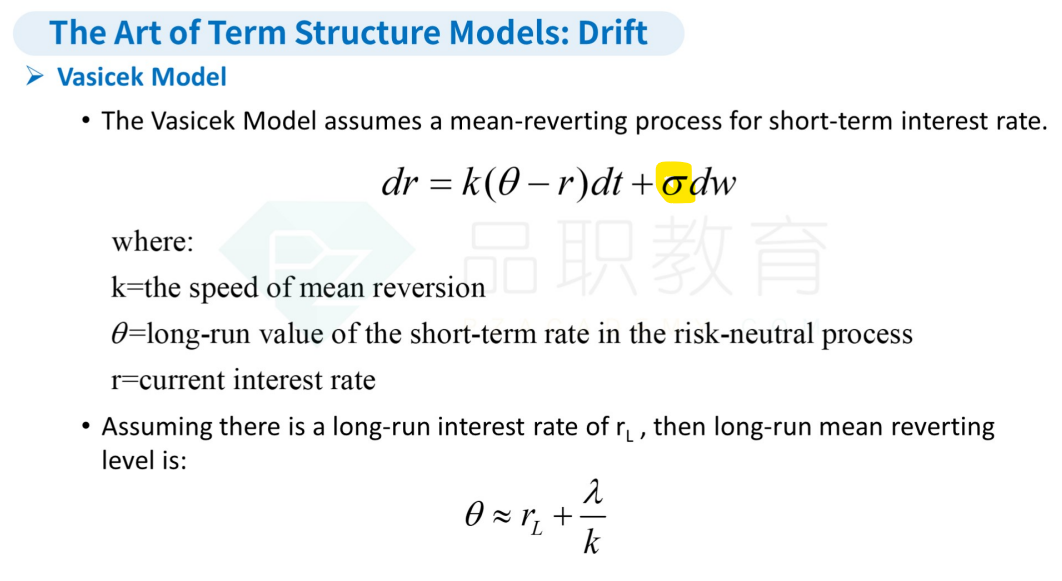

A risk manager at a fixed-income hedge fund is evaluating ways to improve the fund’s ability to model interest

rate term structures. The manager would like to adopt a model that is flexible enough to incorporate mean

reversion as well as a risk premium and considers the Vasicek model for this purpose. Which of the following is

correct about the Vasicek model?

选项:

A.

It incorporates the mean reversion feature and its drift is always zero.

B.

It incorporates the mean reversion feature and models the risk premium as a component of a constant or

changing drift.

C.

It cannot incorporate risk premium and its drift is always zero.

D.

It cannot capture the mean reversion feature but can be used to model the time-varying risk premium.

解释:

中文解析:

B是正确的。Vasicek模型包含了均值回归效应。该模型也考虑了风险溢价,反映在模型中的固定漂移项或者随时间变化的漂移项。

B is correct. The Vasicek model incorporates mean reversion. The flexibility of the model

also allows for risk premium, which enters into the model as constant drift or a drift that

changes over time.

老师v -model怎么看出它的risk premium在哪?