NO.PZ201909280100000906

问题如下:

The specialist hedge fund strategy that Mukilteo plans

to recommend is most likely:

选项:

A.cross-asset volatility trading between the US and

Japanese markets

selling equity volatility and collecting the

volatility risk premium

buying longer-dated out-of-the-money options on VIX

index futures

解释:

C is correct.

Mukilteo needs to recommend a specialist hedge fund strategy that can help PWPF

maintain a high Sharpe ratio even in a crisis when equity markets fall. Buying

longer-dated out-of-the-money options on VIX index futures is a long equity

volatility position that works as a protective hedge, particularly in an equity

market crisis when volatility spikes and equity prices fall. A long volatility

strategy is a useful potential diversifier for long equity investments (albeit

at the cost of the option premium paid by the volatility buyer). Because equity

volatility is approximately 80% negatively correlated with equity market

returns, a long position in equity volatility can substantially reduce the

portfolio’s standard deviation, which would serve to increase its Sharpe ratio.

Longer-dated options will have more absolute exposure to volatility levels (i.e.,

vega exposure) than shorter-dated options, and out-of-the-money options will

typically trade at higher implied volatility levels than at-the-money options.

A is incorrect

because cross-asset volatility trading, a type of relative value volatility trading,

may often involve idiosyncratic, macro-oriented risks that may have adverse

effects during an equity market crisis.

B is incorrect

because the volatility seller is the provider of insurance during crises, not

the beneficiary of it. Selling volatility provides a volatility risk premium or

compensation for taking on the risk of providing insurance against crises for

holders of equities and other securities. On the short side, option premium

sellers generally extract steadier returns in normal market environments.

即使在股市下跌的危机中,也可以帮助投资组合保持高夏普比率。购买 VIX 指数期货的长期out of the money期权是一个选择,它是一种多头股票波动率头寸,可作为保护性对冲,尤其是在波动率飙升和股价下跌的股市危机中。多头波动率策略是多头股票投资的有用的潜在分散器。由于股票波动率与股票市场回报有大约 80% 的负相关,股票波动率的多头头寸可以大幅降低投资组合的标准差,这将有助于提高其夏普比率。与短期期权相比,长期期权对波动率水平的绝对敞口(即 vega 敞口)更多,而且out of the money期权通常会以比in the money期权更高的隐含波动率水平进行交易。

A 不正确,因为 cross-asset volatility trading是一种相对价值波动率交易,通常可能涉及特殊的、面向宏观的风险,这些风险可能在股市危机期间产生不利影响。

B 是不正确的,因为波动率卖方是危机期间的保险提供者,而不是危机的受益者。 卖出波动率提供波动率风险溢价或补偿,以承担为股票和其他证券持有人提供危机保险的风险。 在空头方面,期权溢价卖家通常在正常的市场环境中获得更稳定的回报。

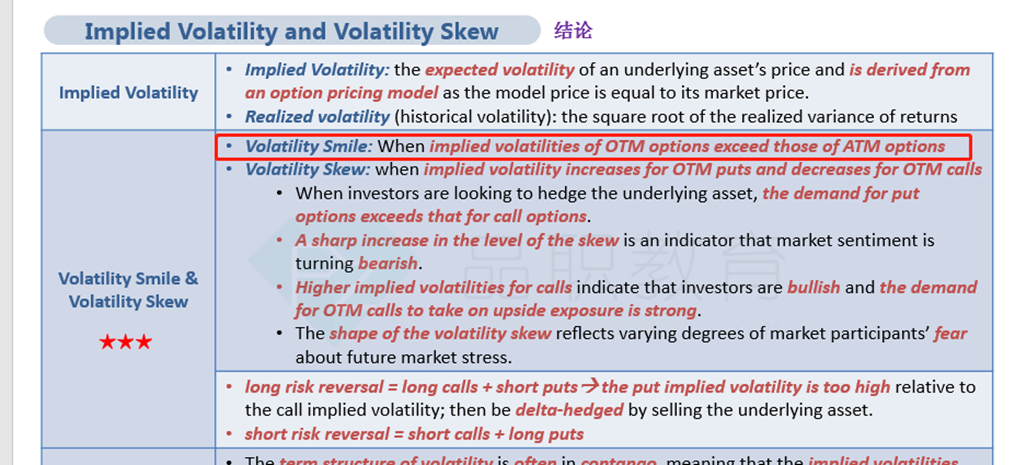

out of the money期权通常会以比in the money期权更高的隐含波动率水平进行交易——为什么呢?