NO.PZ202206140600000202

问题如下:

Based on the client’s investment mandate, the most appropriate appraisal measure for McNeil to use is the:选项:

A.Sortino ratio.

B.Treynor ratio.

C.information ratio.

解释:

SolutionA is correct. Given that the fund mandate requirement is for a short-term return in excess of the risk-free rate, the Sortino ratio is a more appropriate measure because it penalizes returns below a specific return—in this case, 1.5% above the risk-free rate.

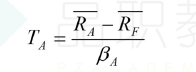

B is incorrect. The Treynor ratio penalizes returns below the risk-free rate. It will not measure the fund’s ability to meet the requirement of a short-term return in excess of the risk-free rate.

C is incorrect. The information ratio evaluates the portfolio return relative to a benchmark. It will not measure the fund’s ability to meet the requirement of a short-term return in excess of the risk-free rate.

Treynor就是目标回报减去无风险利率的回报,不是正好可以用来衡量题目中的特征要求么