NO.PZ2023040402000019

问题如下:

Carlyle explains to Lee that a complete analysis of the impact of a share repurchase should also include an evalua¬tion of the effects on leverage. She points out that Avignon’s most recent bond issue includes a covenant that limits the company’s debt-to-equity ratio to 35%. She asks Lee to prepare an analysis for Avignon, using the information in Exhibit 3, to see if the debt covenant will be violated if the company repurchases shares.

Exhibit 3 Avignon Corporation Selected Financial Information as of Year-End 2016

The best answer to Carlyle’s question about the potential violation of the debt covenants is that the covenant:

选项:

A.will be violated if Avignon uses debt to finance the repurchase.

will be violated if Avignon uses the surplus cash to finance the repurchase.

is not violated if Avignon repurchases shares.

解释:

The debt-financed repurchase increases the debt-to-equity ratio above the 35% threshold and thus violates the debt covenant.

B is incorrect. The D/E stays below 35% when the company uses the surplus cash to finance the repurchase. (See table above: 31.7%.)

C is incorrect. The D/E is above the 35% threshold when the repurchase is financed with debt.

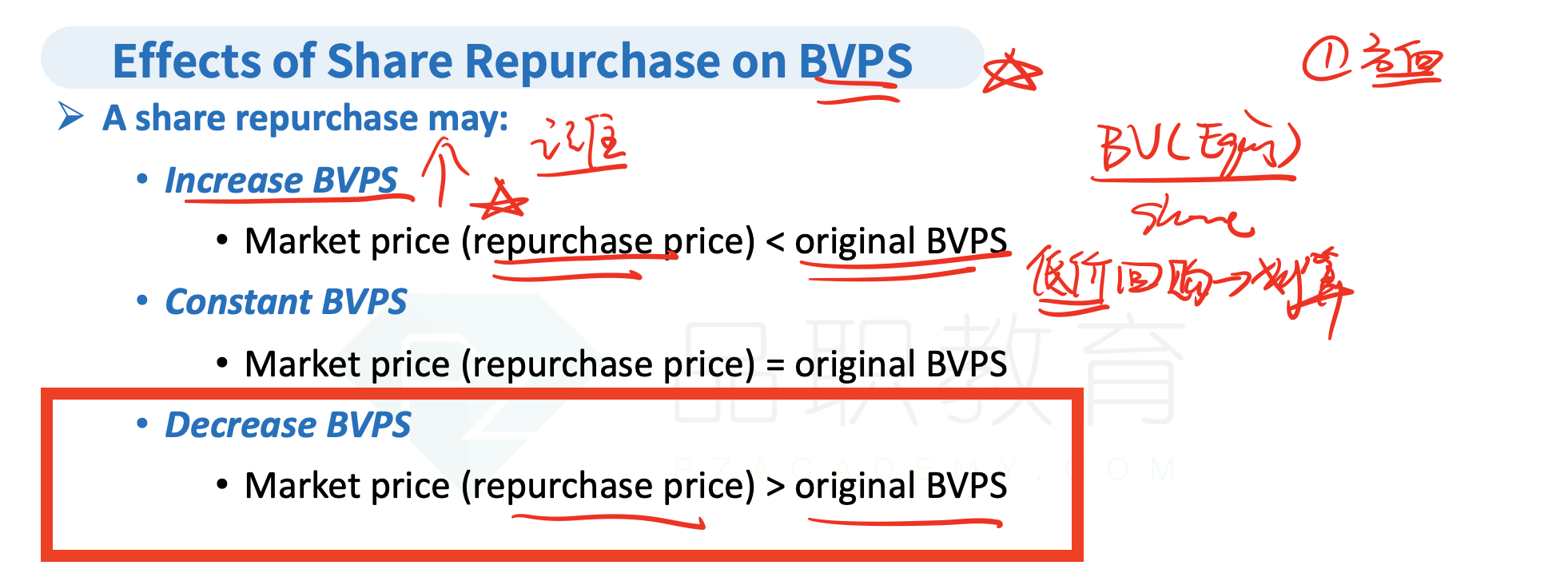

请问下,股票回购后的equity计算,我理解回购的股票会注销,也就是equity只剩下(200-155/32)这么多的股票,book value对应是(200-155/32)*18这么多。和题目的计算方式(3600-155)是不一样的,我的理解有错吗?谢谢。