NO.PZ2018111303000106

问题如下:

On 1 January 2019, PET company acquired a 20% equity interest with voting

power in RED Co. for $400 million. PET company has representation on RED's

board of directors and participates in RED’s policymaking process. Lisa, an

analyst, gathers selected financial information for RED in 2019. The plant and

equipment are depreciated on a straight-line basis and have 10 years of

remaining life.

Based on the Exhibit, the goodwill included in PET’s purchase of RED is:

选项:

A.

$300 million.

B.

$60 million.

C.

$120

million.

解释:

答案:B

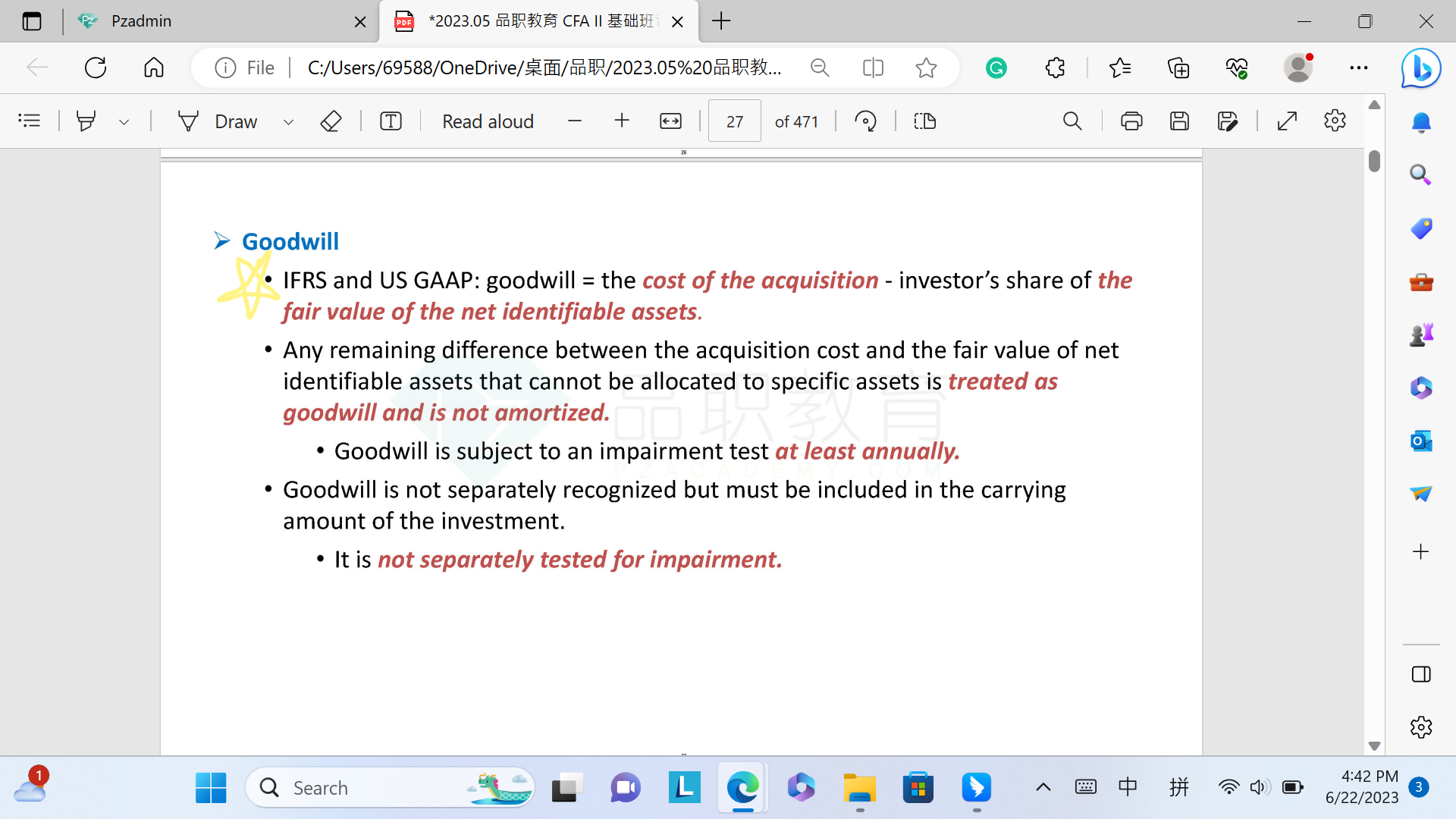

考点:equity method下goodwill的计算。

解析:20%持股比例,且有voting power,BOD中有席位,能够参与经营决策,说明PET公司对RED公司有significant influence,那么应该用equity method。

equity method下goodwill只有一个计算公式,不区分full goodwill还是partial goodwill(acquisition method下才区分)。

goodwill = the cost of the acquisition - investor’s share of the fair value of the net identifiable assets

出价400million,FV of net identifiable assets是1700million,1700×20%=340。

acquisition price超过FV of net identifiable assets的部分就是goodwill,因此goodwill=400-340=60million

【提示】

1、本题给了book value,给了fair value,不需要调整Fair value appreciation,我们直接用fair value代公式即可。

2、本题没有说RED公司账上有unidentifiable资产,说明默认都是identifiable,因此表格中的net assets就等同于net identifiable assets。

为什么good will计算时不考虑增值资产的折旧