问题如下图:

选项:

A.

B.

C.

解释:

看了别人的问题和给出的答案,无论如何都想不通怎么只折两次。

题目说预测未来3年的ROE比较高,从第四年开始ROE回归正常。也就是说用永续年金模式算出来的RI应该是在第三年年末的terminal value,从第三年年末折到第2年年末,第1年年末,再到第0时刻,怎么想都应该是折3次。

同时也应该把第三年EPS-Re*BV算出来的RI加回来吧

元素周期膘 · 2018年05月17日

* 问题详情,请 查看题干

问题如下图:

选项:

A.

B.

C.

解释:

看了别人的问题和给出的答案,无论如何都想不通怎么只折两次。

题目说预测未来3年的ROE比较高,从第四年开始ROE回归正常。也就是说用永续年金模式算出来的RI应该是在第三年年末的terminal value,从第三年年末折到第2年年末,第1年年末,再到第0时刻,怎么想都应该是折3次。

同时也应该把第三年EPS-Re*BV算出来的RI加回来吧

在第三年RI开始保持稳定,那为什么不拿第二年的RI来计算终值?不是第二年末切的一刀么……真的混乱了。

这道题就是课上的例题,讲义236页,为何这样且可以去听下李老师的讲解。

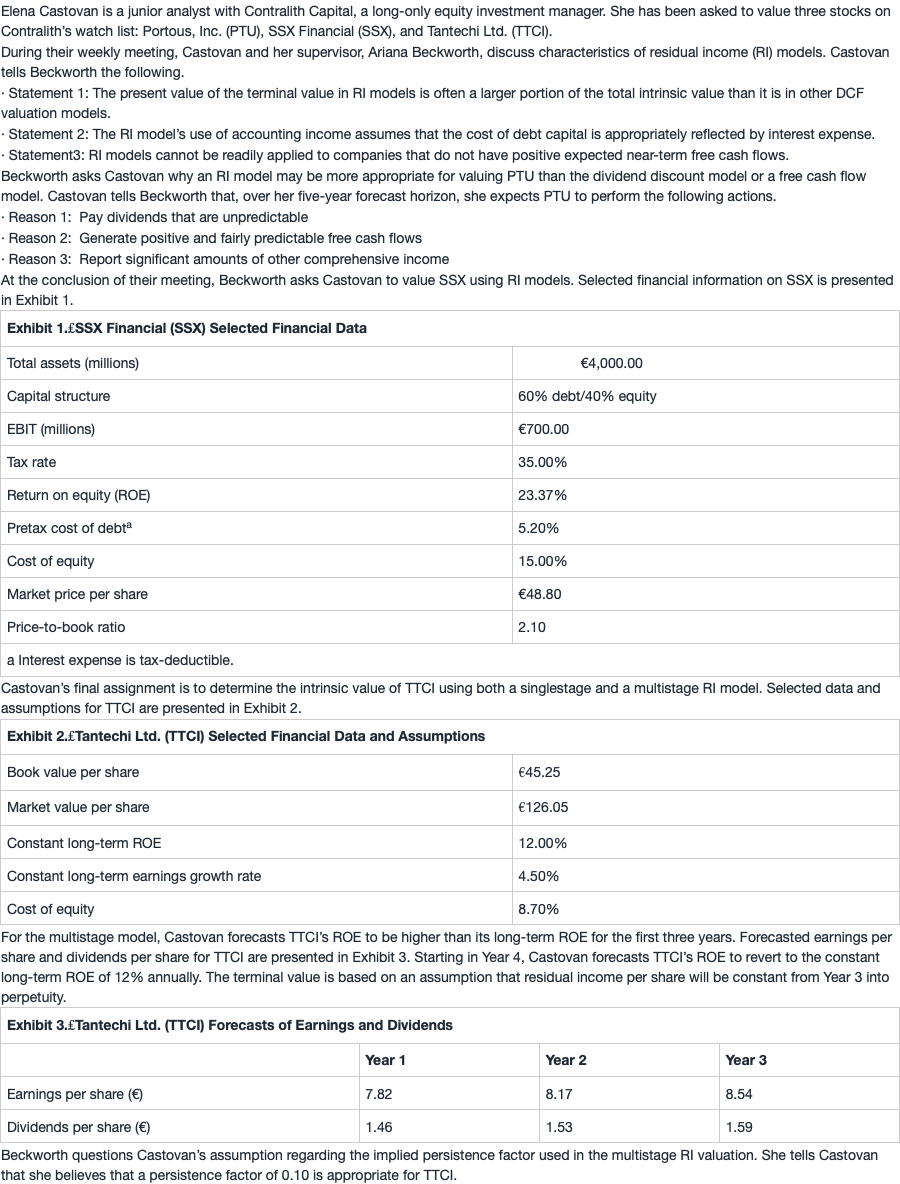

NO.PZ201710200100000408问题如下8. Baseon Exhibits 2 an3 anthe multistage RI mol, Castovshoulestimate the intrinsic value of TTto closest to:A.€54.88.B.€83.01.C.€85.71. C is correct.Resiincome per share for the next three years is calculatefollows.Because Castovforecasts thresiincome per share will constant into perpetuity, equto Ye3 resiincome per share, the present value of the terminvalue is calculateusing a persistenfactor of 1.Present value of terminvalue = 8.54−(0.087×58.25)(1+0.087−1)(1+0.087)2\frac{8.54-(0.087\times58.25)}{(1+0.087-1)(1+0.087)^2}(1+0.087−1)(1+0.087)28.54−(0.087×58.25)= 3.47(0.087)(1.087)2\frac{3.47}{ ( 0.087 ) ( 1.087 ) ^2}(0.087)(1.087)23.47 =33.78 So, the intrinsic value of TTis then calculatefollows.V0=\frac{45.25+3.88/1.087+3.68/(1.087)^2+33.78}=85.71 没搞明白为什么单阶段模型里的PVRI可以用(ROE-r)*B0/(r-g)来计算,这道题多阶段模型的后面说了ROE=12%不变,r=8.7%不变,g也不变,为什么就不能用前面这个公式呢?

NO.PZ201710200100000408问题如下8. Baseon Exhibits 2 an3 anthe multistage RI mol, Castovshoulestimate the intrinsic value of TTto closest to:A.€54.88.B.€83.01.C.€85.71. C is correct.Resiincome per share for the next three years is calculatefollows.Because Castovforecasts thresiincome per share will constant into perpetuity, equto Ye3 resiincome per share, the present value of the terminvalue is calculateusing a persistenfactor of 1.Present value of terminvalue = 8.54−(0.087×58.25)(1+0.087−1)(1+0.087)2\frac{8.54-(0.087\times58.25)}{(1+0.087-1)(1+0.087)^2}(1+0.087−1)(1+0.087)28.54−(0.087×58.25)= 3.47(0.087)(1.087)2\frac{3.47}{ ( 0.087 ) ( 1.087 ) ^2}(0.087)(1.087)23.47 =33.78 So, the intrinsic value of TTis then calculatefollows.V0=\frac{45.25+3.88/1.087+3.68/(1.087)^2+33.78}=85.71 如题,为什么这里是1,其他题没给的话怎么算

NO.PZ201710200100000408 问题如下 8. Baseon Exhibits 2 an3 anthe multistage RI mol, Castovshoulestimate the intrinsic value of TTto closest to: A.€54.88. B.€83.01. C.€85.71. C is correct.Resiincome per share for the next three years is calculatefollows.Because Castovforecasts thresiincome per share will constant into perpetuity, equto Ye3 resiincome per share, the present value of the terminvalue is calculateusing a persistenfactor of 1.Present value of terminvalue = 8.54−(0.087×58.25)(1+0.087−1)(1+0.087)2\frac{8.54-(0.087\times58.25)}{(1+0.087-1)(1+0.087)^2}(1+0.087−1)(1+0.087)28.54−(0.087×58.25)= 3.47(0.087)(1.087)2\frac{3.47}{ ( 0.087 ) ( 1.087 ) ^2}(0.087)(1.087)23.47 =33.78 So, the intrinsic value of TTis then calculatefollows.V0=\frac{45.25+3.88/1.087+3.68/(1.087)^2+33.78}=85.71 如题,谢谢!

NO.PZ201710200100000408 问题如下 8. Baseon Exhibits 2 an3 anthe multistage RI mol, Castovshoulestimate the intrinsic value of TTto closest to: A.€54.88. B.€83.01. C.€85.71. C is correct.Resiincome per share for the next three years is calculatefollows.Because Castovforecasts thresiincome per share will constant into perpetuity, equto Ye3 resiincome per share, the present value of the terminvalue is calculateusing a persistenfactor of 1.Present value of terminvalue = 8.54−(0.087×58.25)(1+0.087−1)(1+0.087)2\frac{8.54-(0.087\times58.25)}{(1+0.087-1)(1+0.087)^2}(1+0.087−1)(1+0.087)28.54−(0.087×58.25)= 3.47(0.087)(1.087)2\frac{3.47}{ ( 0.087 ) ( 1.087 ) ^2}(0.087)(1.087)23.47 =33.78 So, the intrinsic value of TTis then calculatefollows.V0=\frac{45.25+3.88/1.087+3.68/(1.087)^2+33.78}=85.71 题目正文写的persistenfactor 是0.1, 解题里用的是1?

NO.PZ201710200100000408 问题如下 8. Baseon Exhibits 2 an3 anthe multistage RI mol, Castovshoulestimate the intrinsic value of TTto closest to: A.€54.88. B.€83.01. C.€85.71. C is correct.Resiincome per share for the next three years is calculatefollows.Because Castovforecasts thresiincome per share will constant into perpetuity, equto Ye3 resiincome per share, the present value of the terminvalue is calculateusing a persistenfactor of 1.Present value of terminvalue = 8.54−(0.087×58.25)(1+0.087−1)(1+0.087)2\frac{8.54-(0.087\times58.25)}{(1+0.087-1)(1+0.087)^2}(1+0.087−1)(1+0.087)28.54−(0.087×58.25)= 3.47(0.087)(1.087)2\frac{3.47}{ ( 0.087 ) ( 1.087 ) ^2}(0.087)(1.087)23.47 =33.78 So, the intrinsic value of TTis then calculatefollows.V0=\frac{45.25+3.88/1.087+3.68/(1.087)^2+33.78}=85.71 12%这个数据用不到吗?