NO.PZ2020021205000004

问题如下:

Explain the stop-loss strategy for hedging a short position in a call option. What is its drawback?

解释:

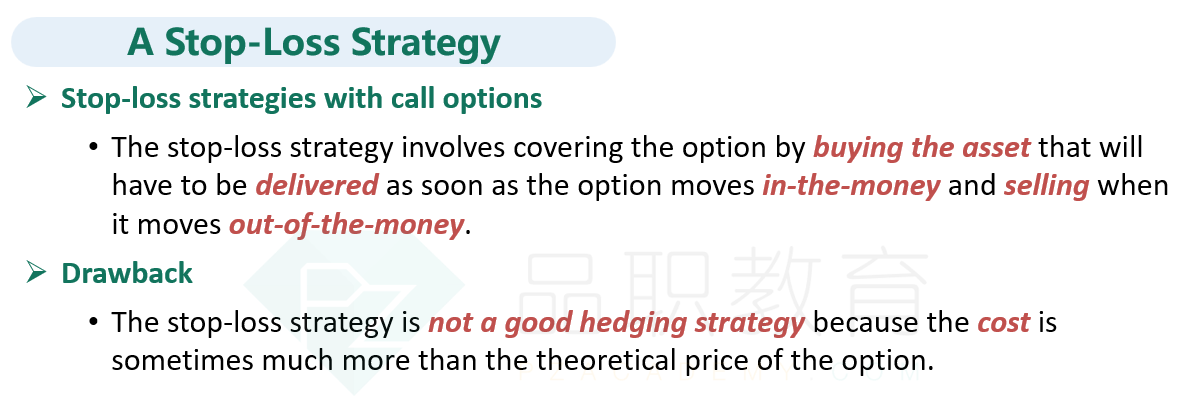

The stop-loss strategy involves covering the option by buying the asset that will have to be delivered as soon as the option moves in-the-money and selling when it moves out-of-the-money. It works well for some scenarios and badly for others. It is not a hedging scheme where the present value of the cost of hedging the option is always approximately equal to its theoretical price.

这题说的是哪个知识点?麻烦老师帮忙翻译并解释意思