NO.PZ201710200100000209

问题如下:

9. Based on Exhibit 4, Intern 2 should conclude that the Xavier stock is:

选项:

A.underpriced.

B.fairly priced.

C.overpriced.

解释:

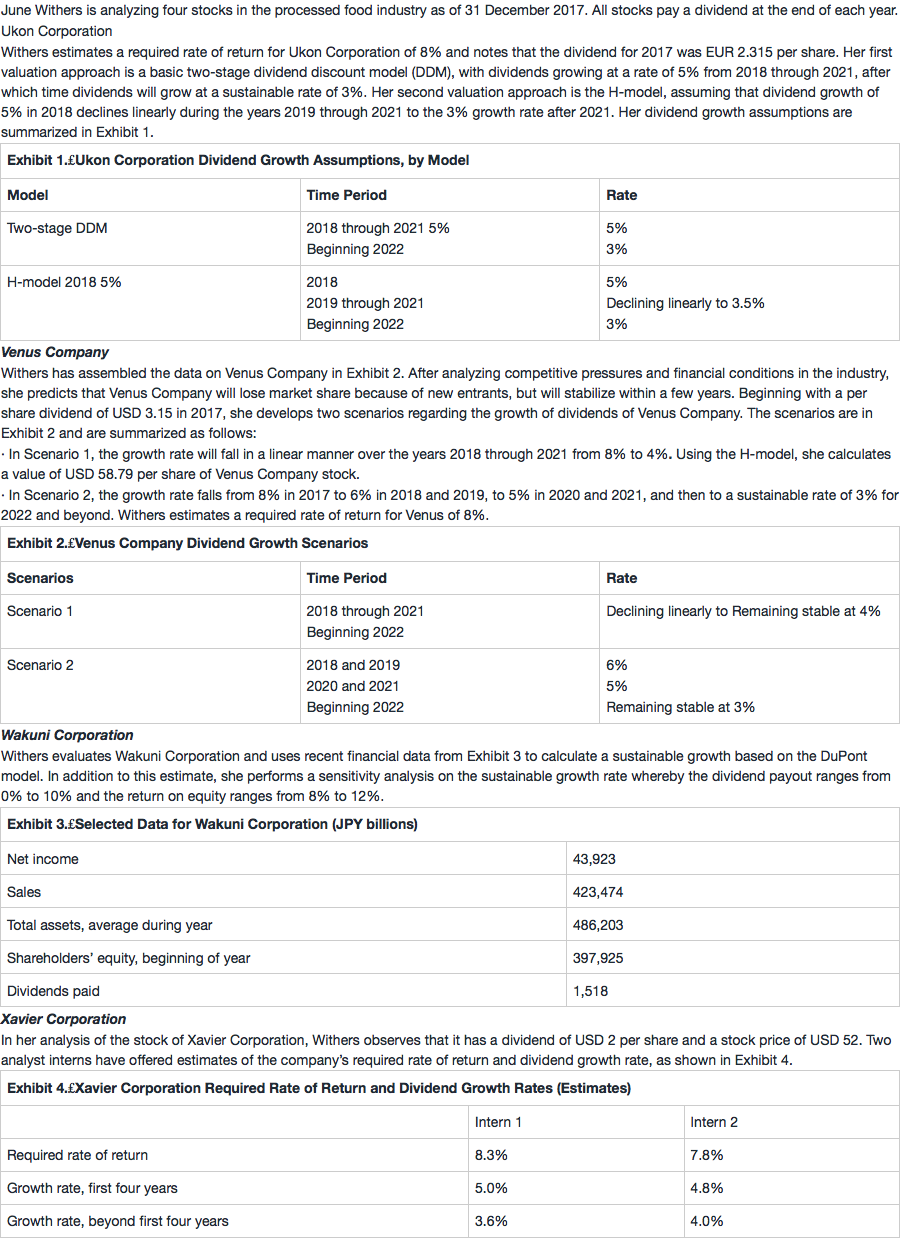

A is correct. Intern 2 values Xavier stock at USD 56.372 per share, which is higher than the current price of USD 52.

D1 = 2.000 × (1.048)1 = 2.096

D2 = 2.000 × (1.048)2 = 2.197

D3 = 2.000 × (1.048)3 = 2.302

D4 = 2.000 × (1.048)4 = 2.413

D5 = 2.000 × (1.048)4 × 1.04 = 2.510

请问这题不能使用implied dividend growth rate的方式反推g(即g=r-D1/P0)来对比两个g从而得出高估低估的原因是不是因为它是两阶段?所以无法直接用这个公式对比。