NO.PZ201909280100000802

问题如下:

2 In answering the question raised in Statement 2, Park would most likely recommend:

选项:

A.

bonds.

B.

hedge funds.

C.

private equities.

解释:

C is correct.

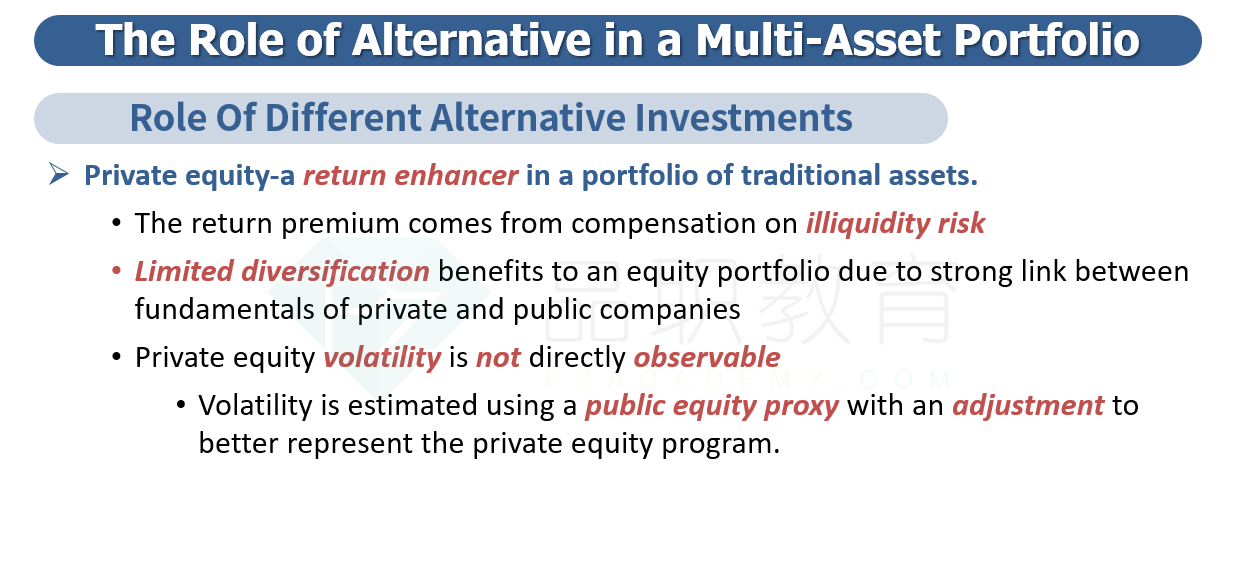

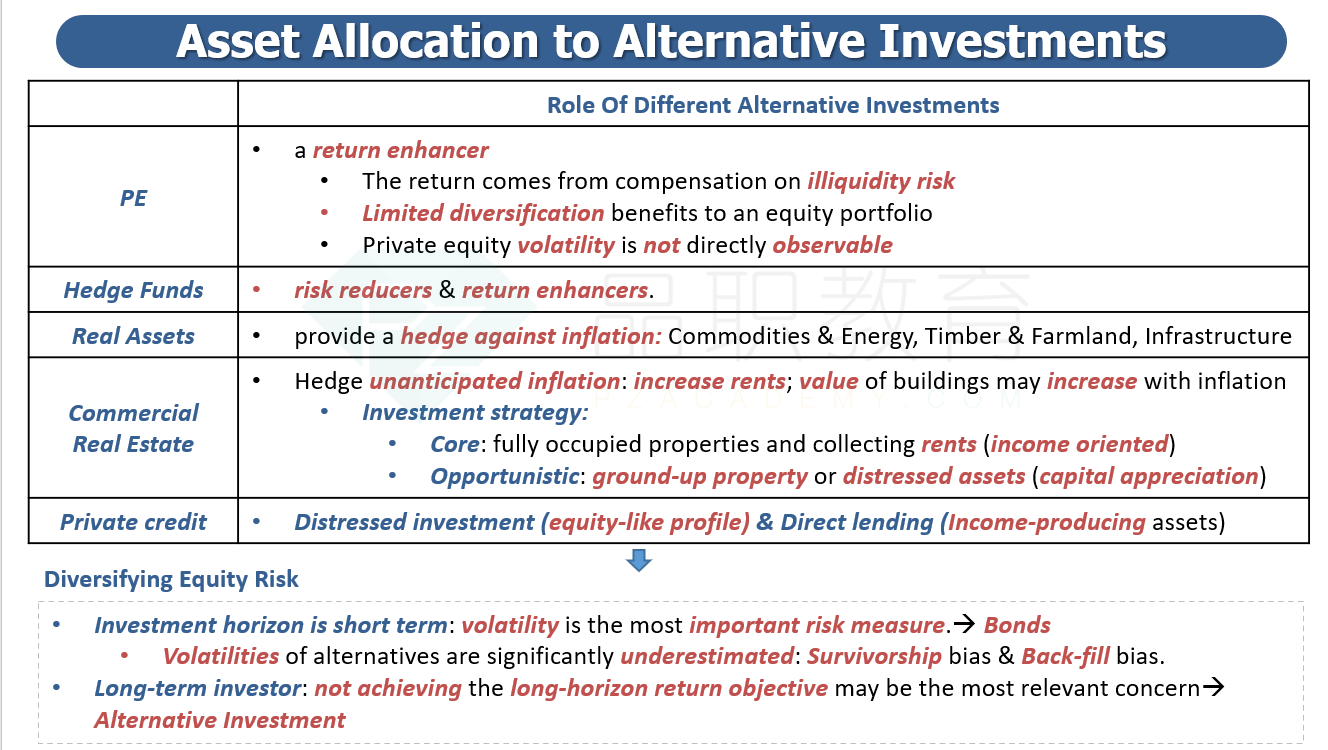

When projecting expected returns, the order of returns from highest to lowest is typically regarded as private equities, hedge funds, bonds. Therefore, the probability of achieving the highest portfolio return while maintaining the funded status of the plan would require the use of private equities in conjunction with public equities. In addition, private equities have a high/strong potential to fulfill the role of capital growth. Fixed-income investments are expected to have a high/strong potential to fulfill the role of safety.

这道题从题干分析,单纯就是让选expected return最高的,根据“PE比hedge fund的return高”这个结论就能解题。这道题没让考虑diversification的问题,题目要求“achieve the greatest probability of maintaining the pension funding status over a long time horizon”,目前funded status是能够不依靠contribution,支付“a number of years”的pension payments,投资目标是希望可以维持这种状态“over a long time horizon”,因为不依靠contribution,那么就只能依靠投资收益,题干又要求“greatest probability”,PE的expected return是最高的,所以选C。

在PPT第几页的考点呢