NO.PZ2016021705000040

问题如下:

The Fulcrum Company produces decorative swivel platforms for home televisions. If Fulcrum produces 40 million units, it estimates that it can sell them for $100 each. Variable production costs are $65 per unit and fixed production costs are $1.05 billion. Which of the following statements is most accurate? Holding all else constant, the Fulcrum Company would:

选项:

A.generate positive operating income if unit sales were 25 million.

B.have less operating leverage if fixed production costs were 10 percent greater than $1.05 billion.

C.generate 20 percent more operating income if unit sales were 5 percent greater than 40 million.

解释:

C is correct.

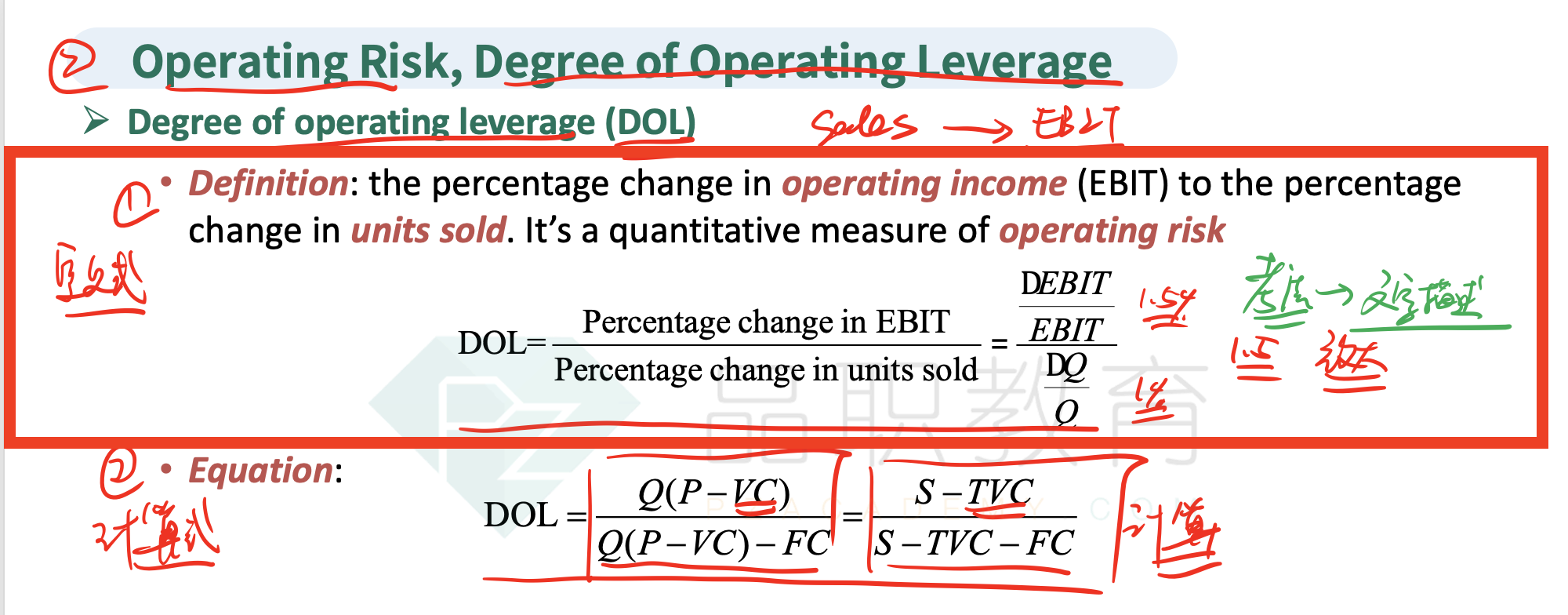

Because DOL is 4, if unit sales increase by 5 percent, Fulcrum’s operating earnings are expected to increase by 4 × 5% = 20%. The calculation for DOL is:

我咋知道它是让我算DOL的