NO.PZ2018062016000143

问题如下:

Claire paid close attention to two portfolios specializing in stocks. The two portfolios were nearly in risk(measured by standard deviation of return) during 2013-2017. Claire believed that the mean monthly return difference between the two portfolio equal to zero and gathered the data of mean monthly retun of two portfolios from 2013-2017. In order to test the hypothesis that the mean monthly return on two portfolios equal from 2013-2017, which of the following test statistic is most appropriate?

选项:

A.

a paired comparisons t-test.

B.

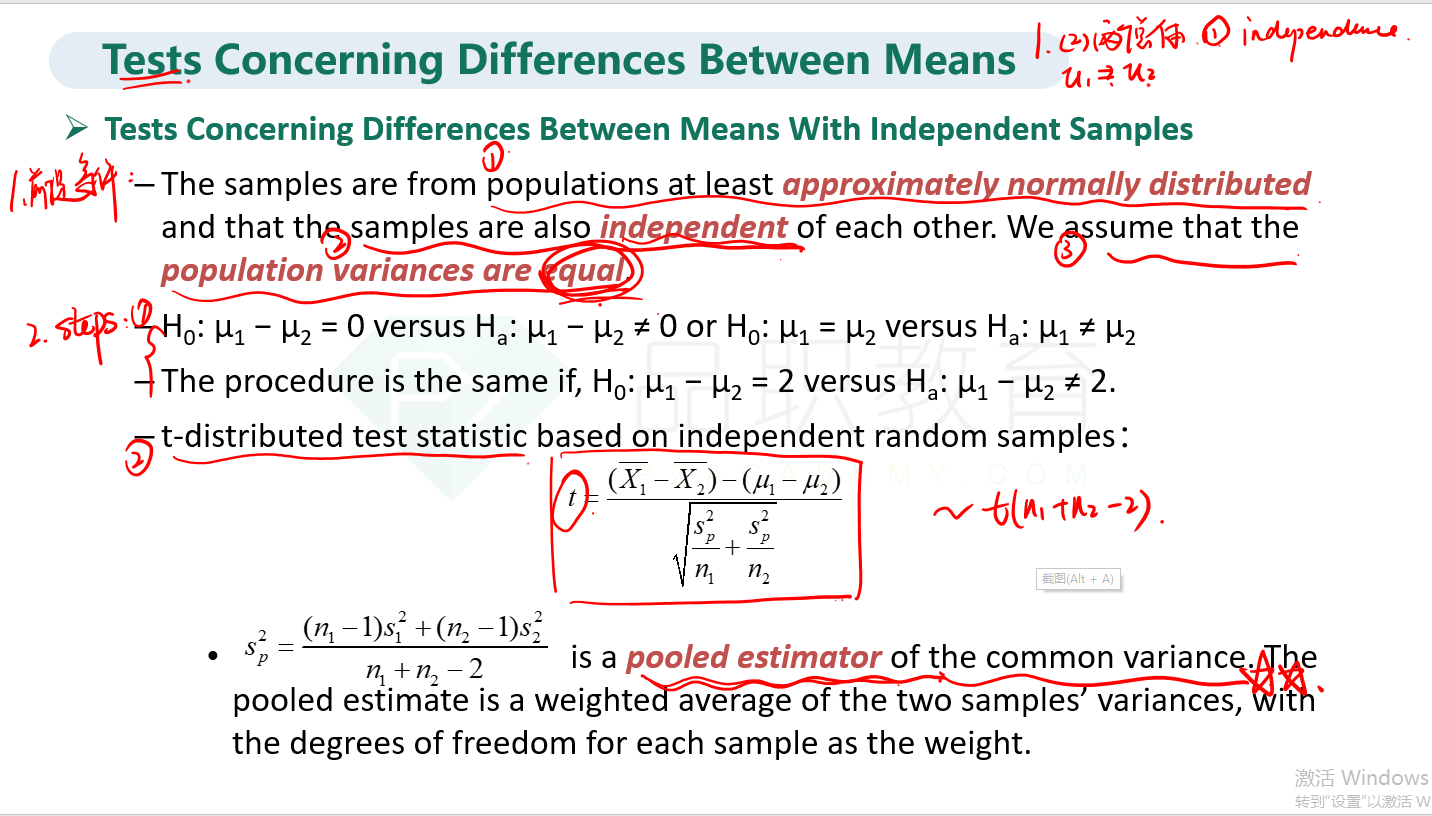

an approximate t-test of mean differences between the two populations.

C.

a t-test of the difference between the two population means.

解释:

A is correct. The two portfolios have the same series of risk factors, so their returns were not independent. Besides, the data is arranged in paired observations. We choose the paired comparisons t-test.

B、C可以翻译和解释下吗